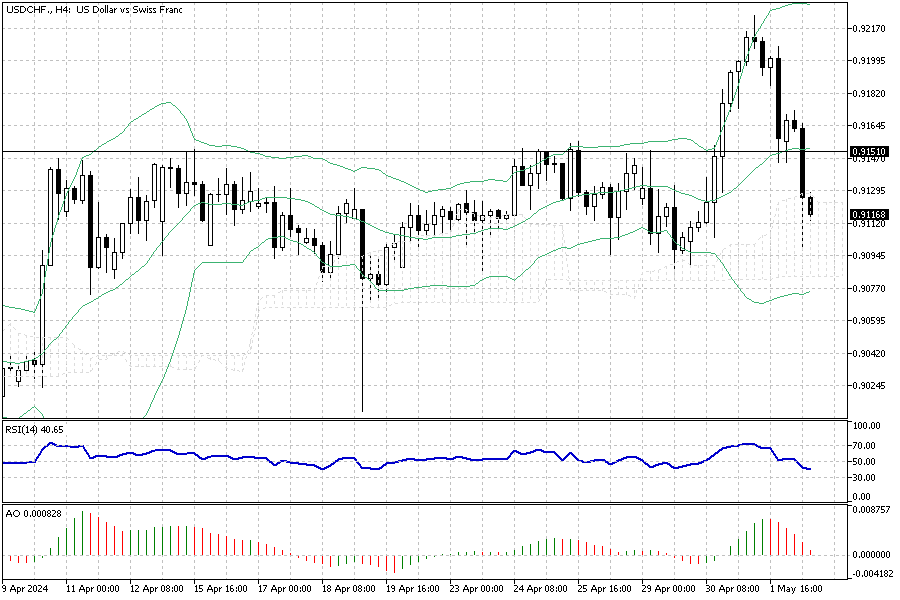

USDCHF – Swiss Franc Rises Amid Inflation Spike

USDCHF Fundamental Analysis—The Swiss franc has experienced a notable rebound, reaching 0.91 per USD from a seven-month low of 0.92 on May 1st. This resurgence came in response to Switzerland’s unexpected inflation surge, prompting financial markets to reassess the likelihood of the Swiss National Bank (SNB) further easing monetary policies.

Inflation Surprises Markets

In April, the annual inflation rate in Switzerland climbed to 1.4%, up from a two-and-a-half-year low of 1% observed in the previous month, surpassing the market forecasts of 1.1%. This unexpected increase has caused a shift in expectations regarding the SNB’s monetary strategy.

Previously, the SNB had indicated that the economic climate remained susceptible to sudden shocks, primarily due to ongoing geopolitical tensions. This vulnerability was reflected in the gradual increase of foreign currency reserves over the past four months, following a significant drop to seven-year lows last November.

Monetary Policy Outlook

The swift escalation in consumer prices last month and the potential for these increases to trigger broader economic effects have tempered speculation about a possible rate cut by the SNB in June. Additionally, the franc’s strength was bolstered by a weakening U.S. dollar, which followed the Federal Reserve’s decision to avoid strong hawkish tones in its recent policy update.

Comments are closed.