GBPUSD – Investors Reassess After New Rate Signals

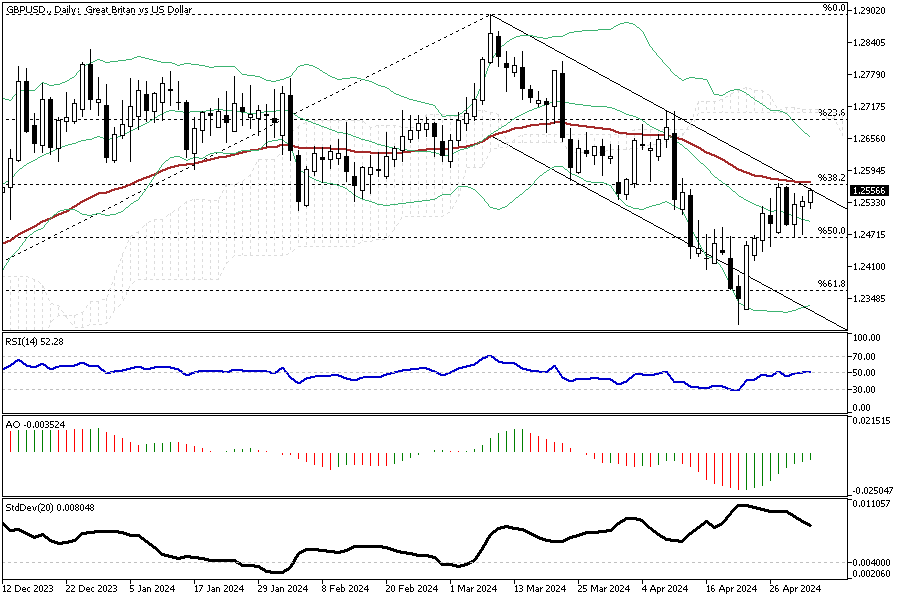

The GBPUSD has recently experienced fluctuations, trading around $1.25. This change comes in the wake of the Federal Reserve’s latest decision to maintain high borrowing costs in the U.S. Although the Fed kept rates steady, Chair Powell indicated no immediate plans for a rate hike, contrary to some expectations.

This stance, reflecting persistent inflation concerns, has significant implications for the Bank of England (BoE) and its monetary policy.

Investors Reassess After New Rate Signals

The probability of an interest rate cut in the near term has decreased in the UK. Initially, market speculations pointed to a potential rate cut as early as August. However, revised expectations now forecast the first cut in September. This shift follows statements from BoE Governor Andrew Bailey, who suggested that inflation in Britain is on track to meet the 2% target.

However, not all officials are in agreement; colleagues Megan Greene and Huw Pill expressed a more cautious perspective, advising that it might be too early to consider reducing interest rates.

Implications for Investors

Investors are now recalibrating their strategies based on these developments. The investment landscape is poised for adjustments with the U.S. maintaining high rates and the UK delaying rate cuts. The differing views within the BoE highlight the uncertainty and complexity of predicting economic trends, urging investors to stay informed and agile.

Comments are closed.