GBPUSD Strengthens – Key Factors Explained

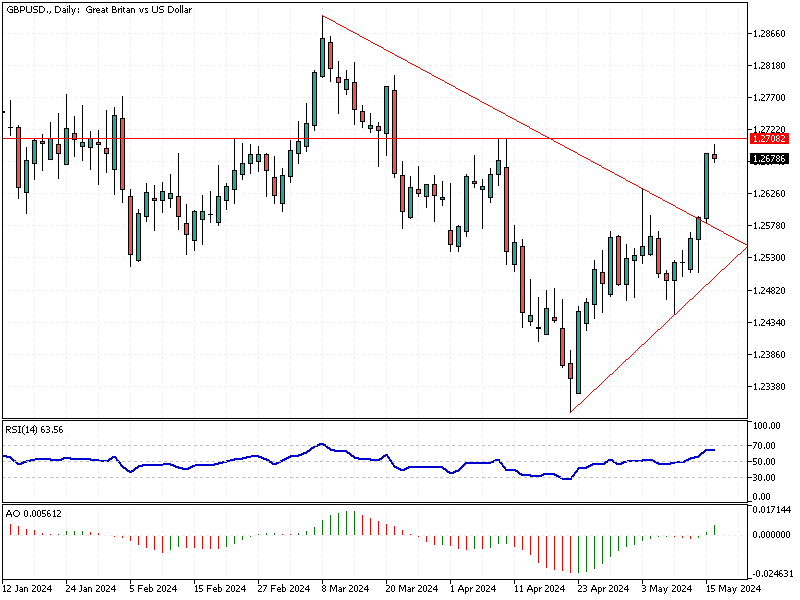

The British pound surged to over $1.264 (GBPUSD), its highest level in five weeks. This rise was primarily due to a weaker dollar following softer US inflation data. The latest figures strengthened the belief that the Federal Reserve might deliver its first rate cut in September.

GBPUSD Strengthens – Key Factors Explained

Bloomberg—In the UK, Bank of England’s Chief Economist Huw Pill hinted at possible rate cuts during the summer. Recent reports showed a cooling job market, with unemployment rising for the third month. Despite this, wage growth remained steady at 6%, aligning with BoE’s predictions.

Increased Rate Cut Probability

The likelihood of a rate cut by the BoE in June has now risen to 50%. Traders are anticipating two quarter-point cuts by the end of the year. However, the timing of the first cut will largely depend on the inflation rate data expected next week.

What This Means for Forex Traders

Understanding these key factors is crucial for forex traders. The interplay between the Fed’s and BoE’s potential rate cuts will significantly influence the GBP/USD pair. Staying informed about upcoming economic reports and central bank announcements will help you make well-timed trading decisions.

In summary, the British pound’s recent surge is driven by expectations of rate cuts from both the Federal Reserve and the Bank of England. To navigate the forex market effectively, traders should monitor inflation data and other economic indicators closely.

Comments are closed.