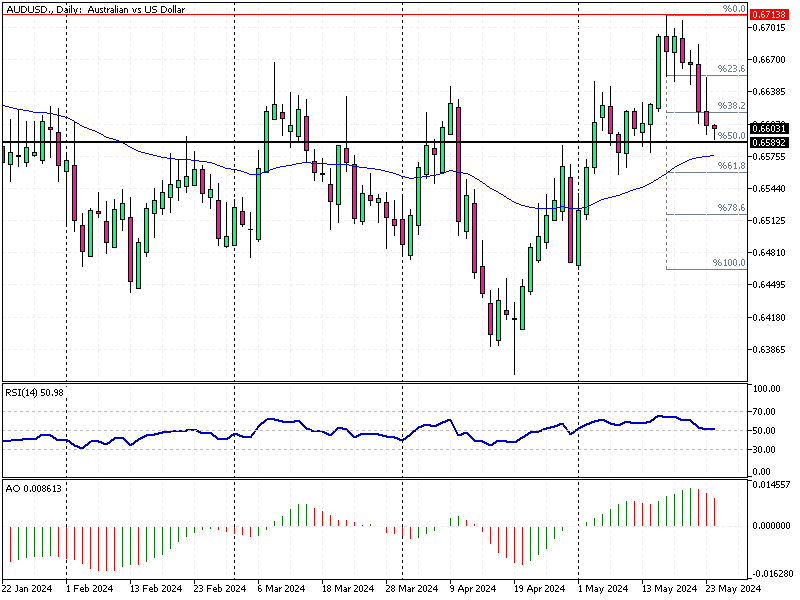

AUDUSD – RBA Debates Rate Hike

The Australian dollar fell below $0.66 (AUD/USD), dropping around 1.5% this week. This decline follows robust US economic data, raising fears that the Federal Reserve might delay cutting interest rates.

AUDUSD – RBA Debates Rate Hike

Bloomberg—Recent FOMC minutes revealed that policymakers are worried about persistent inflation. Some members even indicated they might support further policy tightening if inflation rises again.

Domestically, the Reserve Bank of Australia (RBA) considered raising rates in their latest meeting. However, they decided to maintain the current policy. The RBA noted that predicting future changes in the cash rate is challenging due to mixed data, which increases the risk of prolonged high inflation.

Declining Inflation Expectations in Australia

In a positive sign, consumer inflation expectations in Australia dropped to 4.1% in May. This is the lowest rate since October 2021, suggesting that inflation pressures might be easing.

Summary

The Australian dollar’s recent decline reflects global and domestic economic concerns. As the Fed and RBA navigate inflation and policy decisions, traders should stay informed and be ready for potential market shifts.

Comments are closed.