NZDUSD Fundamental Analysis – RBNZ Holds Rates

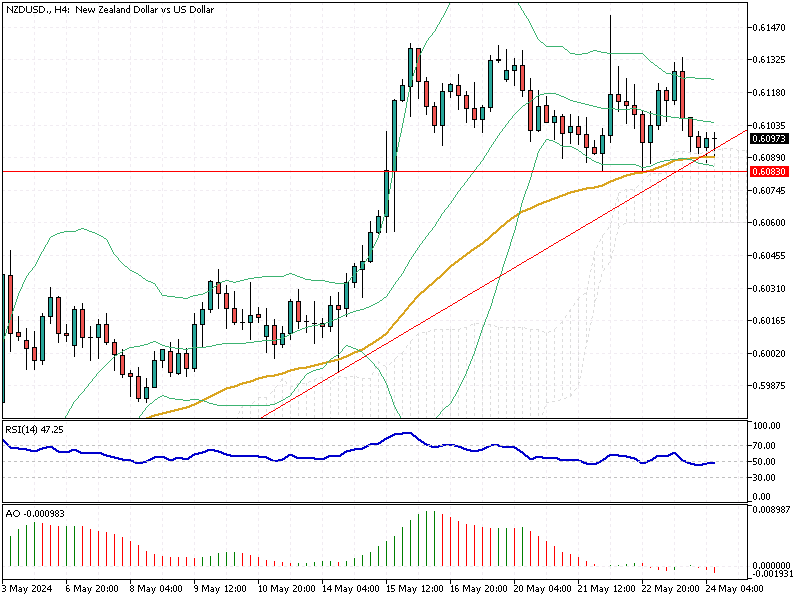

The New Zealand dollar remained around $0.609 (NZD/USD), despite a strong US dollar, due to encouraging US economic indicators. These figures suggest that US interest rates may remain elevated longer.

NZDUSD Fundamental Analysis – RBNZ Holds Rates

On Thursday, the S&P Global’s Flash PMI survey revealed that US business activity in May grew faster than anticipated, reaching its highest level since April 2022. Additionally, weekly jobless claims in the US fell more than expected, highlighting a robust labor market.

RBNZ Maintains High Rates

Bloomberg—At its May meeting, the Reserve Bank of New Zealand (RBNZ) kept its cash rate at 5.5%, a 15-year high, for the seventh consecutive time. Despite high inflation, the RBNZ raised its forecasts for peak interest rates and delayed expectations for rate cuts. Governor Adrian Orr indicated that further rate hikes would only occur if necessary to manage inflation expectations.

Trade Surplus Narrows

New Zealand’s trade surplus decreased in April as exports declined more than imports. This change in the trade balance is another factor for traders and investors to consider when evaluating the NZ dollar’s performance.

By staying updated on these economic developments, traders can make more informed decisions in the dynamic forex market.

Comments are closed.