GBPUSD – Inflation Nears Target Amid Rate Cuts

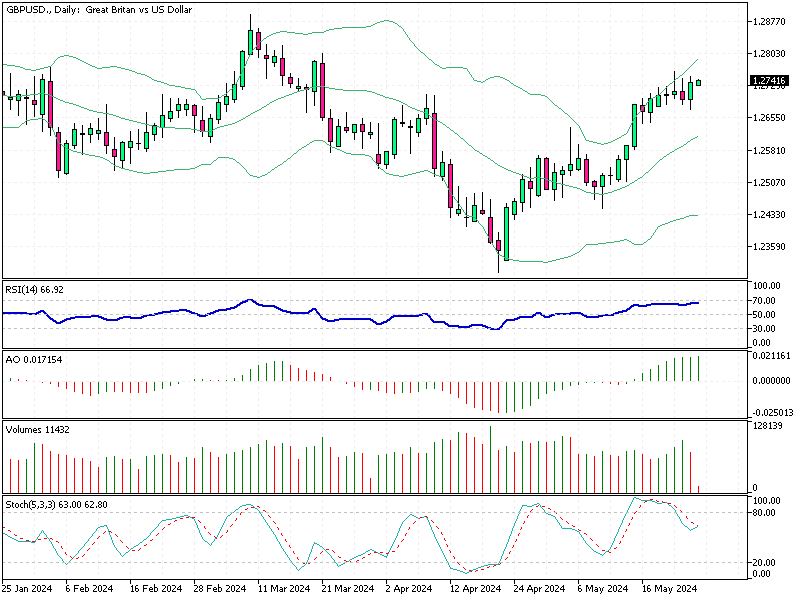

The British pound is holding steady at around $1.274 (GBP/USD), slightly down from earlier in the week but still close to a two-month high. Traders digest critical economic data and assess its impact on future monetary policies.

Retail Sales Plummet

Recent data shows retail sales fell by 2.3% last month, marking the most significant drop this year and far worse than expected. This decline is causing concern among investors and influencing market sentiment.

GBPUSD – Inflation Nears Target Amid Rate Cuts

Better news: the UK’s annual inflation rate has eased to 2.3%, moving closer to the Bank of England’s 2% target. However, it remains slightly above the forecasted 2.1%. This development has shifted expectations regarding interest rate cuts.

With the latest inflation data, investors are less likely to anticipate a rate cut in June. Instead, a slight majority now expects the first cut to happen in September, adding a new layer of complexity to market predictions.

Political Uncertainty Looms

Adding to the uncertainty, Prime Minister Rishi Sunak announced national elections for July 4th. Polls indicate a potential change in government to the Labour Party, raising political risks and further impacting the UK’s volatile borrowing levels.

Comments are closed.