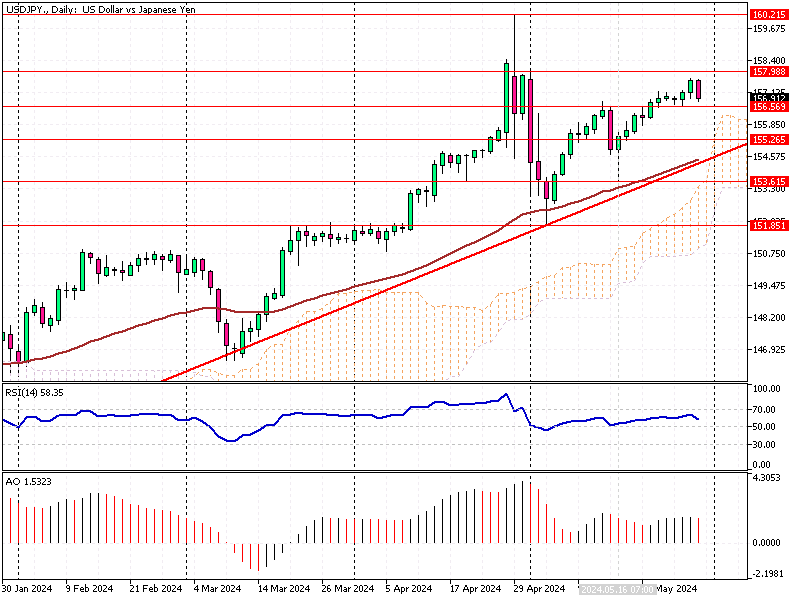

USDJPY Fundamental Analysis – May-30-2024

USD/JPY—The Japanese yen recently fell past 157 per dollar, marking its lowest point in four weeks. This drop is driven by a strong US dollar and rising US Treasury yields.

USDJPY Fundamental Analysis – May-30-2024

A weak auction for US government bonds has raised concerns about bond demand, further strengthening the dollar. Additionally, comments from a Federal Reserve official about potential interest rate hikes have added to these pressures.

The significant gap between US and Japanese yields remains, promoting yen carry trades—where investors borrow yen to invest in higher-yielding US assets. This situation continues to put downward pressure on the yen.

In response to the yen’s depreciation, Bank of Japan board member Seiji Adachi suggested that the central bank might raise interest rates if the yen’s fall leads to higher inflation. This would be a notable shift for Japan, which has maintained low rates for years to support economic growth.

Meanwhile, recent data indicates that Japan’s core inflation rate slowed to 2.2% in April, down from 2.6% in March. This decrease is mainly due to milder food inflation and aligns with market expectations. The overall inflation rate also dropped to 2.5% in April from 2.7% in March, marking the second consecutive month of easing.

Conclusion

The yen’s decline results from complex international financial dynamics, including US bond market performance and interest rate speculation. Japan’s inflation trends show signs of easing, but the economic landscape remains uncertain. Investors and policymakers must closely monitor these developments to navigate the ongoing financial challenges.

Understanding these factors is crucial for making informed financial decisions in the current environment.

Comments are closed.