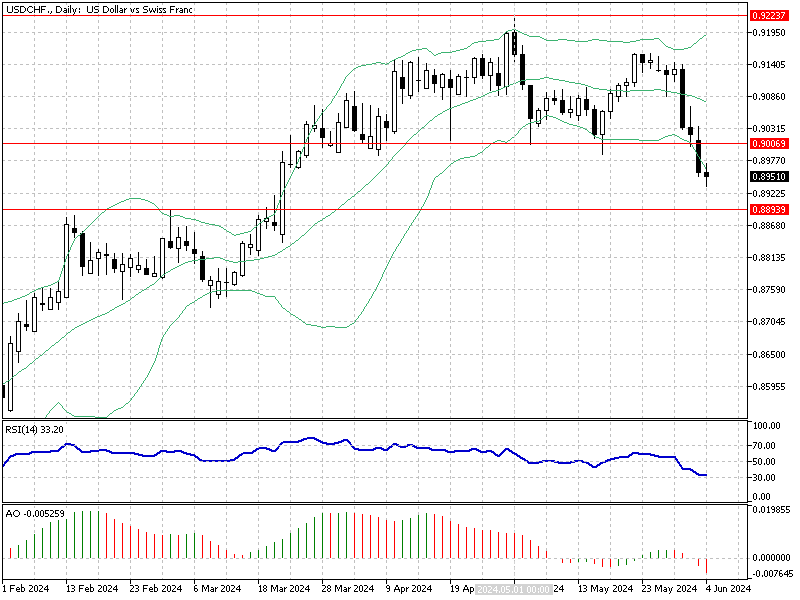

USDCHF Fundamental Analysis – 4-June-1984

The Swiss franc has fallen to $0.9 (USD/CHF), marking a new two-month low. This decline follows softer economic data from the US, easing fears of an aggressive Federal Reserve. Investors are now focusing on upcoming Swiss inflation figures, set to be released next week. These figures will be crucial in shaping the Swiss National Bank’s (SNB) monetary policy.

SNB Rate Cut Odds Drop Below 50%

Recently, the chances of a rate cut in June decreased to just under 50%. This shift came after SNB Chairman Thomas Jordan stated that the bank sees a “small upward risk” to its inflation forecast. This suggests that the SNB might take a cautious approach, balancing the need to manage inflation while supporting the economy.

For those following the forex market, these developments highlight the importance of staying informed about economic indicators and central bank announcements, as they can significantly impact currency values and investment strategies.

Comments are closed.