GBPUSD Fundamental Analysis – 5-June-2042

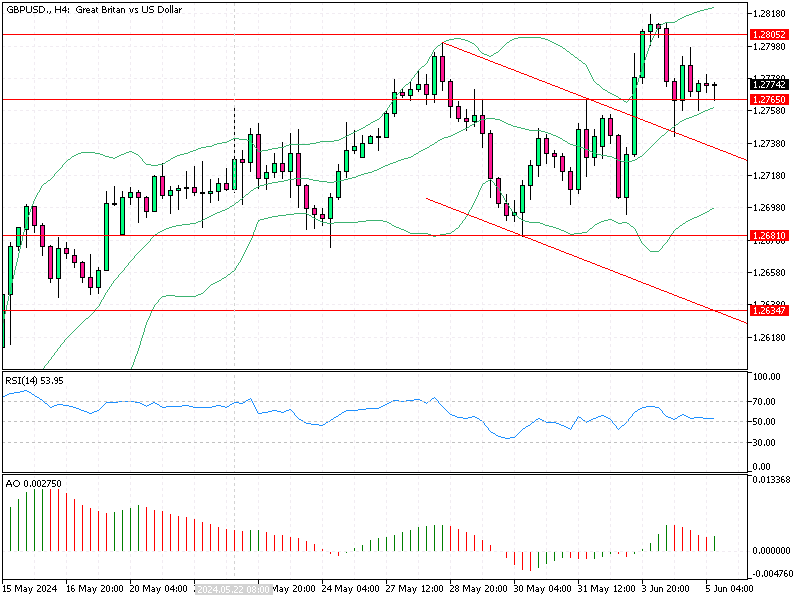

The British pound recently fell to $1.27 (GBP/USD), driven by investors cashing in after its impressive 2% rise in May, marking its best monthly performance this year. With a quiet week ahead for UK-specific economic events, investors are shifting their attention to the European Central Bank (ECB) decision and US employment data.

ECB Rate Cuts Set for 2024 Impact

The ECB is expected to cut interest rates on Thursday, marking the first reduction since 2016. Analysts predict the ECB will reduce rates by around 57 basis points throughout 2024, compared to 33 basis points anticipated from the Bank of England (BoE).

This significant rate cut by the ECB is a crucial factor for investors to consider as it could significantly influence the economic environment and currency markets.

UK Inflation Falls Slower Than Hoped

In the UK, inflation has been decreasing but slower than expected, diminishing the probability of multiple rate cuts by the BoE this year. This slower inflation reduction suggests that the BoE may adopt a more cautious approach to monetary easing.

The political landscape, with a general election set for early July, adds to the economic uncertainty. The outcome of this election could impact economic policies and investor confidence.

BoE June 20 Meeting Insights

The next BoE meeting is scheduled for June 20. Current market expectations, reflected in UK swaps, suggest a rate cut is unlikely before September. This indicates a period of stability and a cautious stance from the BoE in response to current economic conditions and political uncertainties.

Comments are closed.