EURUSD Fundamental Analysis – 11-June-2024

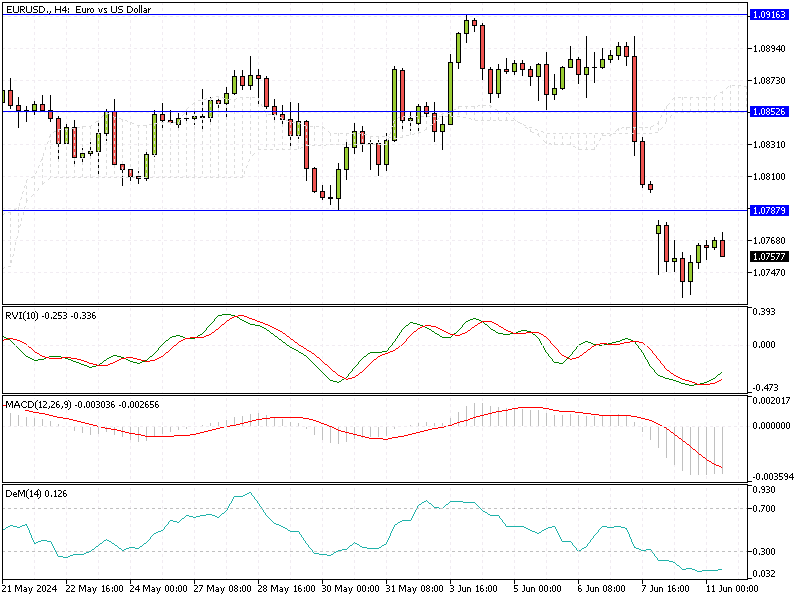

EUR/USD—The Euro slightly increased to $1.77 after hitting a one-month low of $1.07327 on Monday. This fluctuation is attributed to traders digesting the results of the European Parliament elections while awaiting the Federal Reserve’s upcoming monetary policy decision.

Macron Faces New Legislative Challenge

The far-right gained significant traction in the recent European elections. This shift led French President Emmanuel Macron to announce unexpected legislative polls.

While Macron will continue to hold the presidency and maintain control over foreign policy and defense, the new election could impact his legislative power, especially with the anticipated appointment of a new Prime Minister. This development might lead to political uncertainty, influencing economic policies and investor confidence.

ECB Signals Uncertain Future Moves

Last week, the European Central Bank (ECB) made its first rate cut in five years, signaling a cautious stance on further reductions. This move aims to stimulate the economy amidst growing concerns about sluggish growth and geopolitical tensions.

However, the ECB’s careful approach indicates that additional rate cuts are not guaranteed, leaving markets in speculation.

Currency Trends Hinge on Fed Move

As the Federal Reserve prepares to announce its monetary policy decision, global markets remain attentive. The interplay between these major economic events underscores the importance of staying informed and understanding the potential impacts on currency fluctuations and financial stability.

Comments are closed.