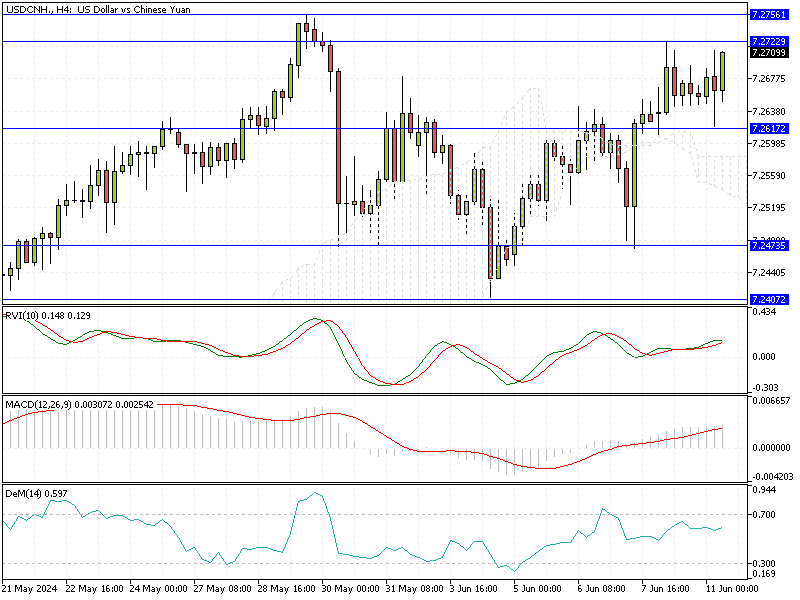

USDCNH Analysis – 11-June-2024

USD/CNH—The offshore yuan steadied at 7.26 per dollar after hitting its lowest level over a month. This recovery came as markets reopened after a long weekend and adjusted to the strong US dollar in global markets.

Earlier losses were minimized due to swift intervention by central state-owned banks, which sold dollars for yuan in the onshore spot foreign exchange market to stabilize the currency.

US Dollar Strengthens Amid Rising Yields

The yuan’s initial weakness was in line with other currencies, influenced by the robust US dollar. The dollar’s strength was driven by rising Treasury yields following strong US jobs data last week. This data reduced traders’ expectations for Federal Reserve interest rate cuts this year.

China’s Economy Hinges on Key Indicators

Now, all eyes are on the upcoming Federal Reserve interest rate decision and key US inflation data. These will provide insights into the future direction of US monetary policy. At the same time, economic indicators from China, particularly inflation figures and credit lending data, will be crucial in assessing the health of China’s economy.

Summary

Understanding these dynamics is essential for making informed financial decisions. In the coming weeks, the interplay between US and Chinese economic data will likely influence currency movements and broader market trends.

However, staying informed about these developments can help investors and businesses navigate the complex global economic landscape effectively.

Comments are closed.