EURUSD Fundamental Analysis – 28-June-2024

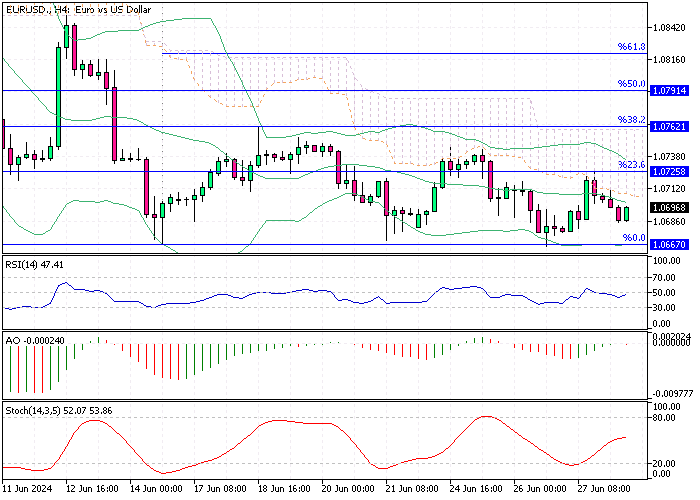

The Euro fell to $1.069, close to a two-month low after Olli Rehn of the ECB suggested two more interest rate cuts could happen this year. Additionally, recent data showed a decline in consumer and business confidence in Germany and France.

Spain’s Inflation Rate Expected to Decline

Considering inflation, preliminary numbers for significant economies like France, Spain, and Italy will be out on Friday. Spain’s yearly inflation rate is predicted to drop to 3.3% in June from 3.6% in May. In Italy, consumer prices are expected to rise by 0.2% from the previous month, the same as in May.

French Election Uncertainty Shakes Investors

Politically, investors are worried about the French legislative election. President Emmanuel Macron’s decision to call a snap election has increased uncertainty. The outcome, whether it supports Marine Le Pen’s far-right party or a leftist coalition, could significantly affect financial markets, especially if there are significant policy changes.

EURUSD Fundamental Analysis – 28-June-2024

The EUR/USD pair is experiencing a downward trend due to several factors. Firstly, the Euro has weakened significantly, reaching $1.0687, driven by comments from ECB Governing Council member Olli Rehn about the possibility of two additional interest rate cuts this year. The ECB’s dovish stance typically makes the Euro less attractive to investors seeking higher yields.

Moreover, recent data reflecting a drop in consumer and business sentiment in Germany and France has further pressured the Euro. Weak confidence in these significant economies signals potential economic slowdowns, negatively affecting the currency.

Upcoming preliminary data for major Eurozone economies, including France, Spain, and Italy, will be crucial on the inflation front. Spain’s annual inflation rate is expected to decline, indicating easing price pressures, while Italy’s consumer prices are projected to remain steady with a slight increase from the previous month. These mixed signals on inflation could lead to varied impacts on the Euro, depending on how they influence ECB policy expectations.

Additionally, political uncertainty in France, heightened by President Emmanuel Macron’s snap election, adds to the volatility. The election results could significantly lead to significant policy shifts if Marine Le Pen’s far-right party or a leftist alliance gains power, further influencing the EUR/USD pair.

Final Words

In summary, the Euro faces downward pressure from potential ECB rate cuts, weak economic sentiment, mixed inflation signals, and political uncertainty in France. These factors collectively contribute to the current weakness of the EUR/USD pair.

Comments are closed.