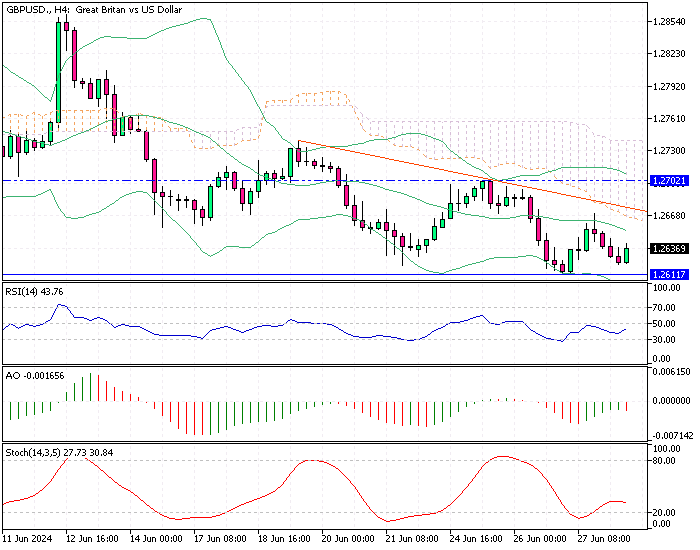

GBPUSD Fundamental Analysis – 28-June-2024

The British pound climbed to $1.263 from a recent six-week low. Investors are evaluating the UK’s monetary policy and political landscape. Last week, the Bank of England (BoE) decided to keep interest rates the same, leading to speculation about a possible rate cut in August based on policymakers’ remarks. A local inflation report also indicated that inflation had fallen to the BoE’s 2% target.

Political Unrest Erupts Over Gamble-gate

Upcoming GDP figures will give more economic insight following Friday’s robust retail sales data, which tempered some optimism from the BoE’s statements. Meanwhile, a scandal known as “Gamble-gate,” involving Prime Minister Rishi Sunak’s aides betting on the election date, has stirred political unrest and threatens to disrupt the rest of the campaign, with Labour expected to win by a large margin.

GBPUSD Fundamental Analysis – 28-June-2024

The GBP/USD pair recently rose, with the pound reaching $1.268. This movement comes after a period of decline, reflecting investor reactions to various economic and political factors in the UK. The Bank of England’s decision to maintain interest rates last week has fueled speculation about a potential rate cut in August. This speculation is based on comments from BoE policymakers, indicating a possible shift in monetary policy.

The domestic inflation report plays a crucial role in this context. The report showed that inflation has reached the BoE’s target of 2%. This development is significant because it suggests that inflationary pressures are under control, which might influence the BoE’s future decisions on interest rates.

Additionally, upcoming GDP numbers are eagerly awaited, as they will provide further insight into the UK’s economic health. Recent robust retail sales data has somewhat moderated the optimism derived from the BoE’s statements, highlighting the importance of these upcoming figures.

Final Words

The “Gamble-gate” scandal involving Prime Minister Rishi Sunak’s aides has introduced significant uncertainty on the political front. This political turmoil will likely impact market sentiment, especially with predictions of a substantial victory for the Labour Party in the upcoming elections. These economic and political factors will continue to shape the GBP/USD pair’s movements in the near term.

Comments are closed.