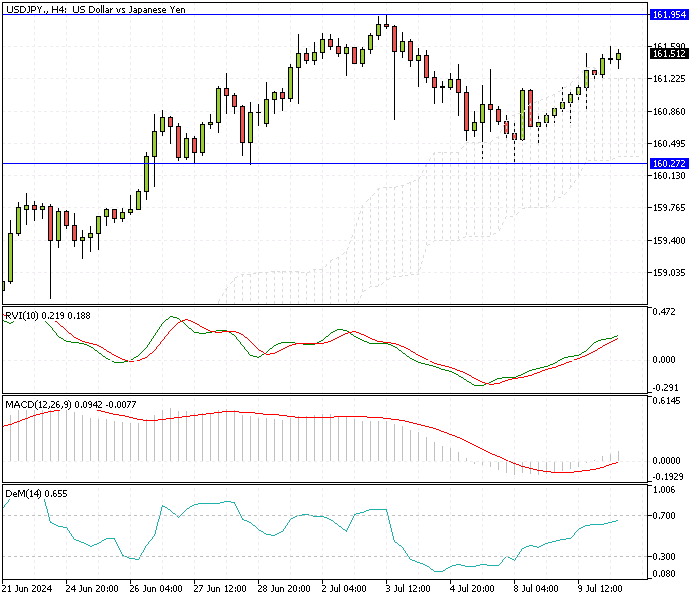

USDJPY Fundamental Analysis – 10-July-2024

The Japanese Yen depreciated to around $161.9 (USD/JPY), nearing its lowest level in 38 years. This significant depreciation stems from international monetary policies and domestic economic conditions. Decoding the factors influencing these movements is essential to understanding the potential implications and forecasting future market trends.

Powell Highlights Need for Inflation Data

The firming up of the U.S. dollar significantly influences the Yen’s depreciation. This strength is mainly due to the Federal Reserve’s cautious stance on interest rate cuts. Jerome Powell, the Chair of the Federal Reserve, emphasized the need for more data before committing to any significant monetary easing.

He indicated that despite signs of cooling in the economy and labor market, there isn’t enough evidence to confidently state that inflation is moving sustainably towards the 2% target.

Yen Weakens as BoJ Meeting Approaches

Simultaneously, the Yen has weakened ahead of the Bank of Japan’s (BoJ) policy meeting in July. There are widespread expectations that the BoJ might raise interest rates and announce plans to taper its bond purchases. This anticipated move is driven by mounting Pressure on the BoJ to adopt a more aggressive stance in normalizing monetary policy.

A weak yen increases import costs, exacerbating inflationary pressures within the country. Hence, the BoJ’s actions are crucial in stabilizing the Yen and controlling inflation.

Rising CGPI Signals Inflation in Japan

Japan’s domestic economic indicators also play a pivotal role in this scenario. The corporate goods price index (CGPI) increased by 2.9% year-on-year in June, marking the highest reading since August.

The CGPI measures the prices of goods sold by corporations and is a critical indicator of inflationary trends within the economy. This increase signifies rising business costs, which can translate to higher consumer prices, further fueling inflation.

USDJPY Fundamental Analysis – 10-July-2024

Given these dynamics, several forecasts can be made regarding the Yen and the broader Japanese economy.

Continued Pressure on the Yen: As long as the Federal Reserve maintains its cautious approach and the U.S. dollar remains strong, it will likely stay under Pressure. This depreciation can continue unless the BoJ takes more decisive action in its monetary policy adjustments.

Potential BoJ Policy Shifts: The upcoming BoJ meeting is critical. If the central bank raises interest rates and announces a reduction in bond purchases, it could support the Yen. Such moves would signal a shift towards tighter monetary policy, which could help curb inflation by stabilizing import costs.

Inflationary Concerns: With the CGPI rising, inflation remains a significant concern for Japan. A weak yen exacerbates this issue by making imports more expensive. The BoJ’s policy decisions will be pivotal in managing these inflationary pressures and ensuring economic stability.

Final Word

The Japanese Yen’s depreciation to near-record lows reflects a complex interplay of international and domestic economic factors. The Federal Reserve’s cautious stance on interest rate cuts strengthens the U.S. dollar, thereby pressuring the Yen.

Meanwhile, the BoJ faces the challenge of normalizing monetary policy to counteract inflationary risks driven by a weak yen and rising corporate goods prices. As the BoJ’s July policy meeting approaches, all eyes will be on its decisions and their potential impact on the Yen and Japan’s broader economic landscape.

Staying informed about these developments is crucial for investors and market watchers to make sound financial decisions in the current economic environment.

Comments are closed.