USDCHF Fundamental Analysis – 15-July-2024

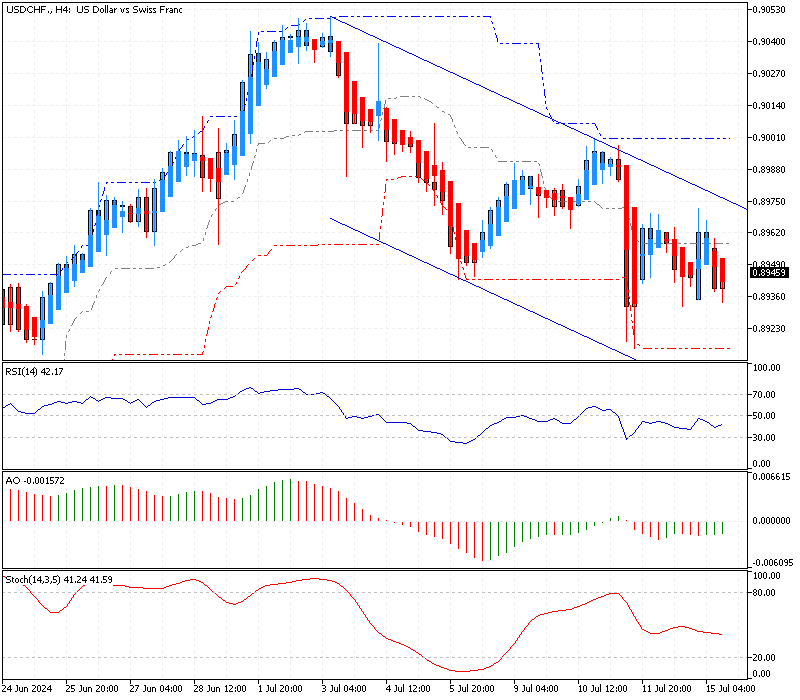

The Swiss franc is trading around $0.89 (USD/CHF), approaching its lowest point in five weeks. This movement comes as traders analyze recent economic and monetary developments within Switzerland and globally.

Switzerland Inflation Eases in June

Switzerland’s inflation rate was lower than expected in June, recording 1.3% compared to 1.4% in the previous two months. This slight drop in inflation reflects a relatively stable economic environment, yet it also signals a cautious outlook for future economic growth. In response to these economic conditions, the Swiss National Bank (SNB) recently lowered its key interest rate by 25 basis points for the second consecutive meeting.

SNB Cuts Rates to Boost Economy

The SNB’s decision to reduce interest rates indicates a strategic effort to stimulate economic activity by making borrowing cheaper. This move contrasts with the actions of other major central banks like the Federal Reserve (Fed) in the United States and the European Central Bank (ECB). While the Fed has yet to ease borrowing costs, the ECB remains hesitant to reduce rates further, highlighting a divergence in global monetary policies.

The Swiss National Bank’s approach reflects a unique stance in the current economic landscape. The SNB aims to support domestic economic growth and control inflation by lowering interest rates and fostering a stable financial environment. In contrast, the Fed’s reluctance to ease borrowing costs suggests a focus on curbing inflation, a significant concern in the U.S. economy.

US Dollar Drops Amid Fed Speculation

Despite the Swiss franc’s recent depreciation, the U.S. dollar has decreased since late June. This decline in the dollar’s value is attributed to increasing market speculation that the Fed will eventually lower borrowing costs within the year. Investors are betting on this potential shift in monetary policy, which could impact global financial markets.

USDCHF Fundamental Analysis – 15-July-2024

The interplay between these monetary policies and economic indicators is crucial for traders and investors. The SNB’s proactive stance in lowering interest rates aims to maintain financial stability in Switzerland, even as other central banks adopt more conservative approaches. Meanwhile, the U.S. dollar’s weakening trend reflects changing market expectations regarding future Fed actions.

Final Word

In summary, the Swiss franc’s recent performance underscores the complexities of the global economic landscape. Traders and investors must stay informed about these developments to make strategic decisions. As the Swiss National Bank adjusts its policies in response to domestic and international economic conditions, understanding these dynamics will be essential for navigating the financial markets.

Comments are closed.