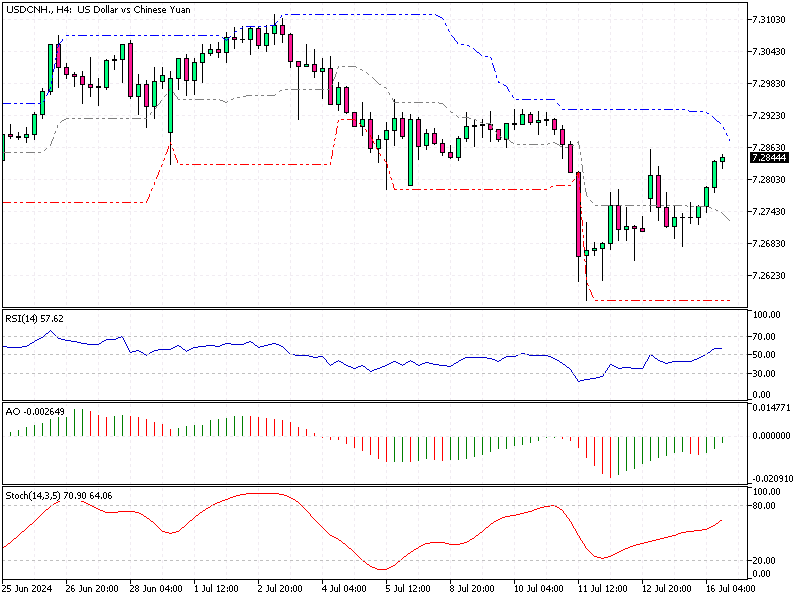

USDCNH Analysis – 16-June-2024

The offshore yuan has recently weakened, surpassing the $7.28 (USD/CNH) mark. This depreciation followed a series of underwhelming Chinese economic indicators, negatively impacting market sentiment.

Chinese Economy Faces Q2 Slowdown

The Chinese economy grew slower than expected in the second quarter of 2024, with significant challenges arising from an extended property market downturn and growing concerns over employment. These factors have dampened hopes for a robust economic recovery, leading many to anticipate that Beijing might introduce additional stimulus measures to support the economy.

Offshore Funding Limits Yuan’s Steep Decline

Despite the yuan’s depreciation, its decline was moderated by tight offshore funding conditions. These conditions made it difficult for investors to short the currency, thus preventing a steeper fall. Shorting a currency involves betting its value will decrease, but the tight funding conditions acted as a barrier to these investment strategies.

Insights from China’s Third Plenum

Market attention is turning towards the Third Plenum, a high-level leadership conference scheduled from July 15 to 18. Investors eagerly await policy insights from this event, although the focus is expected to be on longer-term economic and social issues rather than immediate economic measures. The outcomes of the Third Plenum could provide crucial insights into China’s future policy directions and economic strategies.

USDCNH Analysis – 16-June-2024

Understanding these dynamics is vital for investors and market participants. The weaker yuan reflects underlying economic challenges in China but also points to potential opportunities for government intervention. If Beijing introduces new stimulus measures, it could bolster economic growth and stabilize the yuan.

Final Word

In conclusion, the recent weakening of the offshore yuan highlights significant economic challenges within China, particularly in the property market and employment sectors. Investors should closely monitor the Third Plenum for policy signals that could impact the market. Market participants can make more informed decisions and better navigate the evolving economic landscape by staying informed about these developments.

Comments are closed.