USDJPY Fundamental Analysis – 18-July-2024

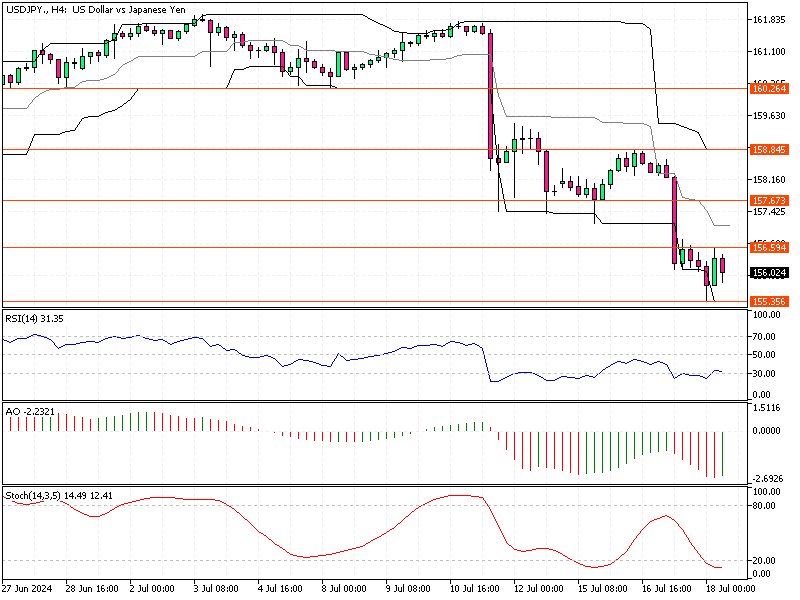

USD/JPY—The Japanese yen significantly surged, reaching $155.37 on Thursday before retreating. This six-week high followed a suspected intervention by Japanese authorities to stabilize the currency.

During Wednesday’s trading session, the yen appreciated by about 1.4%, continuing its upward trend of around 2% from the previous week. Central bank data suggests authorities may have intervened by purchasing nearly 6 trillion yen on July 11-12.

Ministry of Finance Boosts Yen Value

Such a large-scale intervention by the Ministry of Finance, combined with a weaker dollar due to lower inflation data in the US, led markets to reconsider shorting the yen. A short squeeze likely occurred, where investors betting against the yen were forced to buy back the currency to cover their positions, further driving up its value.

BOJ July Meeting Sparks Investor Interest

Looking ahead, all eyes are on the Bank of Japan’s (BOJ) policy meeting scheduled for late July. Investors are keen to see if the BOJ will announce plans to taper its bond purchases, which could signal a shift in its monetary policy. Additionally, there is speculation that the BOJ might raise interest rates again, further supporting the yen.

On the economic front, Japan reported a surprising trade surplus in June. This was primarily due to exports growing faster than imports, indicating a stronger-than-expected performance of the Japanese economy.

USDJPY Fundamental Analysis – 18-July-2024

For investors, these developments suggest a potential shift in the Japanese market. The yen could continue strengthening if the BOJ reduces its bond purchases and raises interest rates. This could impact Japanese exports by making them more expensive abroad but could also attract foreign investment into Japanese assets due to higher yields.

Final Word

In summary, the recent surge in the yen is driven by suspected government intervention and favorable economic data. The BOJ policy meeting will determine the yen’s trajectory and market dynamics. Investors should stay informed about these developments to make strategic decisions in this evolving economic landscape.

Comments are closed.