USDCHF Fundamental Analysis – 6-August-2024

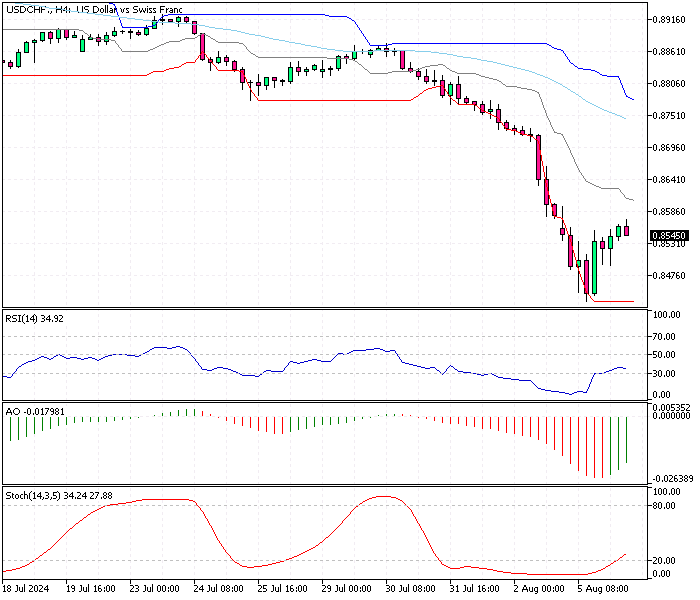

Recently, the Swiss Franc strengthened to about $0.854 (USD/CHF), a level not seen since the start of this year. This significant appreciation is largely due to the dollar’s weakening, which is influenced by growing concerns about the strength of the US economy.

Disappointing Jobs Report Sparks Rate Cut Speculation

These concerns were heightened by a disappointing jobs report, which showed fewer jobs were created than expected. As a result, there is increased speculation that the Federal Reserve might have to lower interest rates three times this year instead of just twice, as previously anticipated.

Additionally, the possibility of an economic slowdown has prompted many investors to adopt a flight-to-safety strategy. This means they are moving their investments to safer assets, like the Swiss Franc, considered a stable and reliable currency. This trend has further supported the Franc’s appreciation.

Swiss Inflation Steady at 1.3% in July

In the meantime, Switzerland’s annual inflation rate held steady at 1.3% in July 2024. This rate was unchanged from the previous month and aligned with market experts’ predictions. This stable inflation rate has reinforced expectations that the Swiss National Bank (SNB) will implement a third consecutive interest rate cut in September.

The SNB has been proactive, having begun its monetary easing policies earlier than many of its global counterparts. So far this year, the SNB has reduced borrowing costs in both policy meetings.

- Also read: USDJPY Fundamental Analysis – 6-August-2024

Final Word

In summary, the combination of a weaker US dollar, concerns over the US economy, and a stable inflation rate in Switzerland has led to the Swiss Franc’s recent strength.

Investors seeking safer assets and the proactive measures by the Swiss National Bank have further supported this trend, indicating a continued strong performance for the Swiss Franc shortly.

Comments are closed.