AUDUSD Fundamental Analysis – 15-August-2024

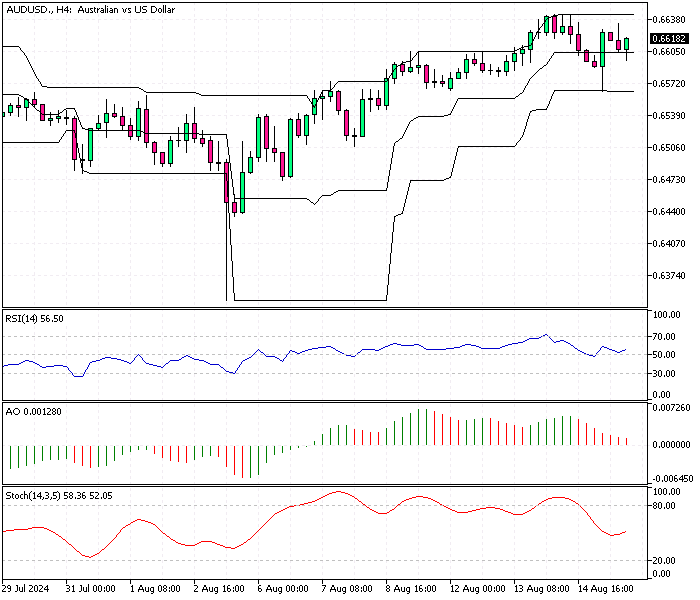

The Australian dollar climbed above $0.661 (AUD/USD), continuing its recent upward momentum. Investors responded to a mix of domestic and international economic developments.

Inflation Expectations Rise in Australia

In August, a private survey revealed that consumer inflation expectations in Australia increased to 4.5%, up from 4.3% in July. This marks the highest level since April and suggests growing consumer concerns about rising prices.

Such inflationary pressures can influence the Reserve Bank of Australia’s (RBA) future decisions, keeping markets attentive.

Surprising Unemployment Data Adds Uncertainty

At the same time, Australia’s unemployment rate unexpectedly rose to 4.2% in July, its highest level over two years. Analysts did not anticipate this increase, which adds a layer of uncertainty to the economic outlook.

Rising unemployment can signal potential economic slowing, making it crucial for investors to monitor these changes closely.

RBA Holds Interest Rates But Remains Ready to Act

Last week, the Reserve Bank of Australia decided to keep interest rates steady at 4.35% for the sixth consecutive meeting. Despite holding rates, RBA Governor Michele Bullock emphasized that the central bank remains committed to combating inflation and will not hesitate to increase rates again if needed.

This cautious stance highlights the RBA’s balancing act between controlling inflation and supporting economic growth.

Easing US Inflation Provides External Support

On the global front, the Australian dollar gained additional support from recent data indicating easing inflation in the United States. This trend boosts optimism that the Federal Reserve may consider cutting interest rates in the near future, which generally supports higher-risk currencies like the Australian dollar.

Investors view this as a positive sign for broader economic conditions, further fueling the Aussie’s rally.

Kiwi Dollar Weakens After Surprise Rate Cut

The Australian dollar strengthened and gained ground against the New Zealand dollar. The Reserve Bank of New Zealand unexpectedly cut its cash rate by 25 basis points to 5.25%, marking the first reduction since March 2020.

This surprising move contrasts expectations and suggests growing concerns about New Zealand’s economic outlook, making the Australian dollar more attractive.

Conclusion: Balancing Economic Signals

Overall, the Australian dollar’s rise reflects a complex interplay of domestic inflation expectations, surprising unemployment figures, cautious monetary policy from the RBA, and favorable external factors.

As global and local economic conditions evolve, the Aussie remains a currency to watch closely for those interested in global markets.

Comments are closed.