EURUSD Fundamental Analysis – 16-August-2024

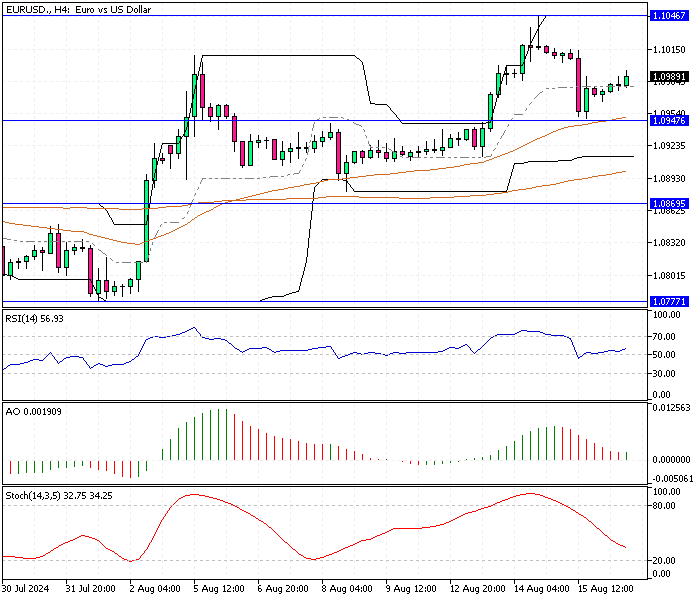

The euro remains steady around $1.098 (EUR/USD) after reaching a seven-month peak, surpassing $1.1 earlier in the week. This marks an increase of approximately 0.7% over the past week, reflecting its resilient performance despite various market uncertainties.

Investors closely monitor currency trends as they weigh the impact of central bank decisions on future market behavior.

ECB’s Rate Cuts and Market Sentiment

The European Central Bank (ECB) implemented a quarter-point rate cut in June, but market sentiment remains cautious. Even with this rate adjustment, traders worry that the U.S. Federal Reserve (Fed) might adopt a more aggressive stance regarding rate cuts.

Currently, there’s a 25% probability that the Fed could opt for a more substantial 50 basis-point cut in their upcoming September 18 meeting, a decision that would have broad implications for global currency markets.

The Influence of U.S. Economic Data on Rate Expectations

The expectation for further Fed rate cuts was heightened after the release of a weaker-than-anticipated July U.S. jobs report. However, strong retail sales figures provided relief, easing concerns about a significant economic downturn.

This balance between softening employment data and robust consumer spending has led to mixed speculations regarding how aggressive the Fed’s next move will be.

ECB’s Future Rate Cut Plans in Focus

Market participants expect the ECB to proceed with two additional rate cuts on the European front by mid-October. These anticipated cuts are part of the ECB’s broader strategy to stimulate economic activity amid slowing growth and inflationary pressures.

As Europe’s economic outlook remains uncertain, the ECB’s future actions will likely continue to influence regional and global markets.

What’s Next for the Euro?

As these central bank decisions unfold, the euro’s strength will largely depend on how these policies balance. Investors and traders alike will closely watch upcoming economic indicators, central bank meetings, and other significant developments.

In the coming weeks, how the Fed and ECB navigate these challenges will play a crucial role in determining the euro’s direction and broader market sentiment.

Comments are closed.