NZDUSD Fundamental Analysis – 16-August-2024

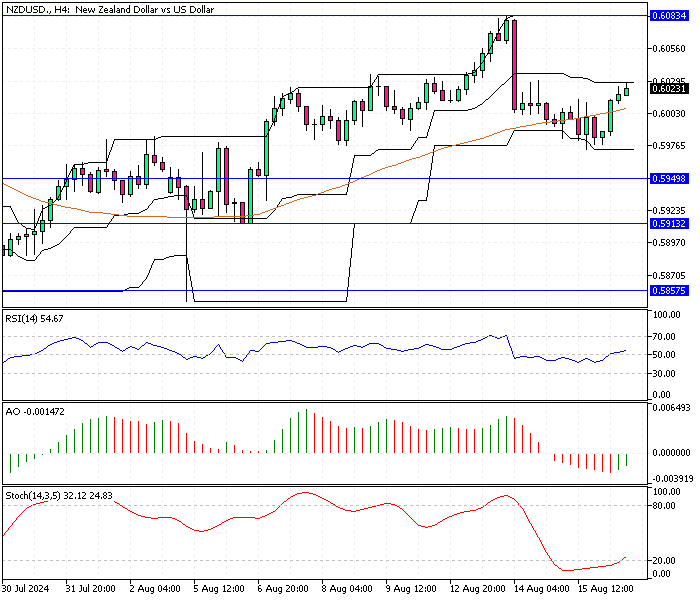

The New Zealand dollar bounced back to around $0.602 (NZD/USD) after experiencing a two-day decline. This recovery is partly due to a dip in the US dollar ahead of the release of US consumer confidence data expected later today.

Market attention is also on the Federal Reserve, which is anticipated to cut interest rates in September, although the exact size of the cut is uncertain.

Reserve Bank of New Zealand’s Recent Rate Cut

Earlier this week, the Reserve Bank of New Zealand (RBNZ) made a significant move by reducing its benchmark interest rate to 5.25%. This is the first time since March 2020 that the central bank has taken such action.

The RBNZ also hinted at more rate cuts in the near future as part of its strategy to stimulate the economy.

Central Bank Governor Signals Inflation Under Control

In a recent statement, RBNZ Governor Adrian Orr expressed confidence in the bank’s success in controlling inflation. He emphasized that inflation is now comfortably within their 1-3% target range, signaling a stable economic environment.

This development is crucial as it suggests New Zealand’s economy may be heading towards more predictable growth after facing inflationary pressures.

Mixed Economic Data Paints a Complex Picture

While the interest rate cuts and controlled inflation are positive signs, New Zealand’s economic data tells a more complex story. Manufacturing activity in July showed slight improvement but remained in contraction for the 17th month, reflecting ongoing challenges in this sector.

Additionally, producer inflation stayed high, with both input and output prices rising more than expected during the second quarter. This persistent inflation indicates that businesses face elevated costs, which could have broader economic impacts.

Outlook: Uncertainty and Strategic Decisions Ahead

Looking forward, the New Zealand economy is at a crossroads. The RBNZ’s future rate cuts and the Fed’s decisions will likely majorly shape the country’s financial landscape.

On the one hand, inflation appears to be under control, but challenges in the manufacturing sector and persistent inflation pressures suggest that careful policy adjustments are still needed.

Comments are closed.