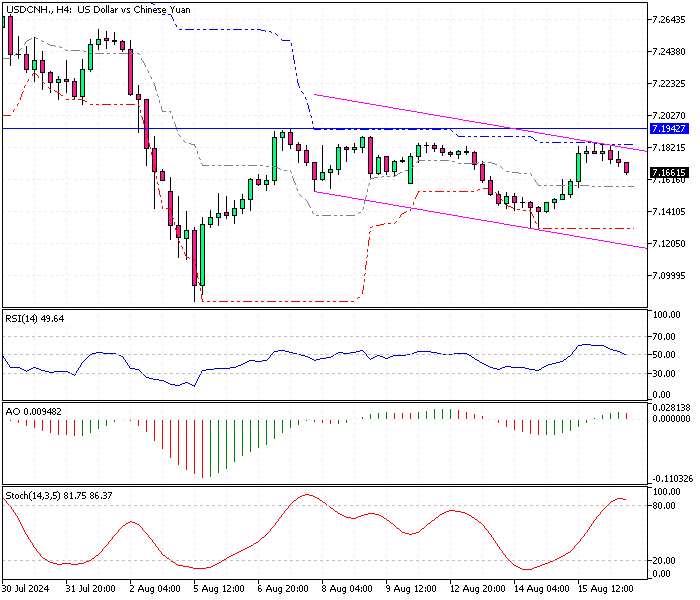

USDCNH Fundamental Analysis – 16-August-2024

The offshore yuan slipped beyond 7.166 (USD/CNH) per dollar, losing momentum from a recent one-week high. This drop reflects the complex mix of economic signals coming out of China and the growing strength of the U.S. dollar.

The Chinese economy continues sending mixed messages, making it challenging for the currency to stabilize.

Housing Market Troubles Deepen in China

July 2024 brought concerning news for China’s real estate sector. New home prices recorded their steepest fall since June 2015, indicating that Beijing’s stabilization measures may not be enough to halt the ongoing decline.

The persistent drop in property values points to deeper issues within the housing market, which has long been a critical component of China’s economy. The slump in property prices raises red flags about overall consumer confidence and financial health in one of China’s key sectors.

Industrial Growth Slows, Unemployment Edges Up

Adding to the challenges, industrial output in July showed clear signs of slowing down. Growth was the weakest it has been since March, reflecting broader concerns about the pace of China’s economic recovery.

Meanwhile, the unemployment rate nudged higher after staying flat for the last three months. This upward trend in joblessness suggests that the labor market may face increased strain, adding another layer of pressure on the government’s efforts to stabilize the economy.

Retail Sales Offer a Glimmer of Hope

On a brighter note, retail sales continued to grow in July, accelerating spending. This marks the 18th straight month of expansion, suggesting that domestic consumption remains resilient despite other economic headwinds.

The steady rise in retail sales is a positive sign, hinting that consumer activity could help counterbalance some weaknesses in other sectors. If this trend holds, it could be crucial to sustaining overall economic growth.

External Pressures: The Strengthening U.S. Dollar

Beyond China’s internal struggles, the yuan’s depreciation is also driven by external factors, particularly a robust U.S. dollar. Recent data from the U.S. revealed stronger-than-expected economic performance, easing fears of a recession and making the dollar more attractive to global investors.

This surge in the greenback puts additional downward pressure on the yuan, creating a challenging environment for China’s currency as it faces domestic and international hurdles.

Comments are closed.