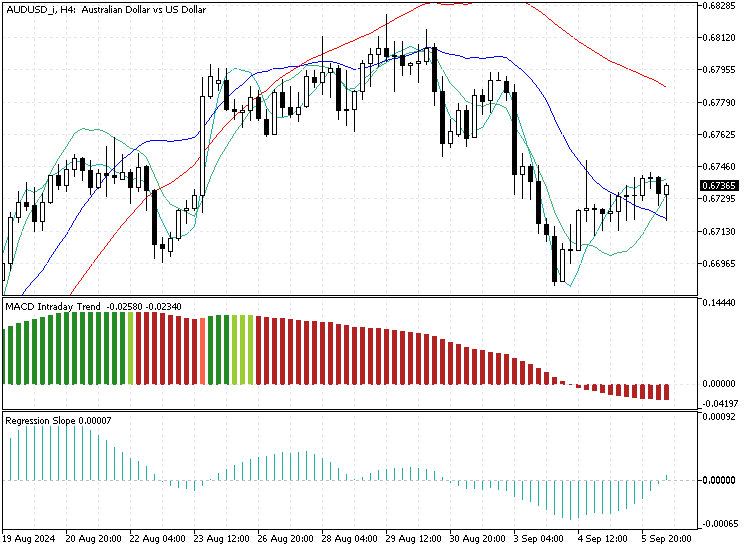

AUDUSD Fundamental Analysis – 6-September-2024

The Australian dollar remained stable above $0.673 (AUD/USD) following the Reserve Bank of Australia’s decision to keep interest rates unchanged during the August meeting. According to the RBA Governor Michele Bullock, this pause was due to concerns about inflation being too high.

The central bank is focused on reducing inflation to its target range of 2-3% while protecting recent job market gains. This decision reflects a careful balance between controlling inflation and maintaining employment levels.

Australia’s Trade Surplus Boosts Economic Confidence

In July, Australia’s trade surplus reached its highest point in five months, with exports increasing and imports decreasing. This positive trade balance boosted the economy, reflecting growing international demand for Australian goods.

Such trends indicate that external factors contribute to the country’s financial stability, helping support the currency and the broader economy.

Modest Economic Growth Falls Short of Expectations

Earlier in the week, official data showed that Australia’s economy grew by 0.2% in the year’s second quarter, maintaining the same growth rate as the previous two quarters. While growth continued, it fell slightly below market predictions of 0.3%.

The steady pace suggests the economy is holding up despite global challenges, highlighting the need for continued caution in monetary policies.

US Dollar Weakness Benefits the Aussie

Externally, the Australian dollar got a boost from the weakening US dollar. Recent poor economic data from the US raised concerns about a possible recession, prompting investors to speculate that the Federal Reserve may lower interest rates more aggressively.

This pullback in the US dollar made the Australian currency more attractive to investors, further supporting its value.

Comments are closed.