EURUSD Fundamental Analysis – 9-September-2024

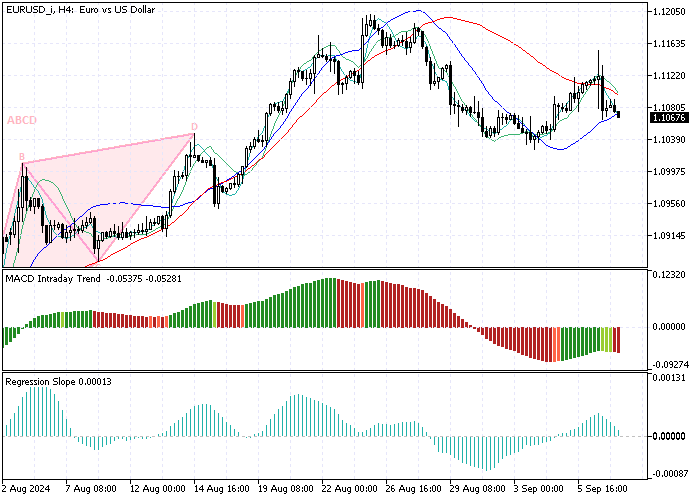

The euro dipped below $1.106 (ERU/USD) after reaching a peak of $1.111 on September 5th. Investors scrutinized recent economic reports to gauge potential interest rate cuts by the European Central Bank (ECB) and the Federal Reserve.

Economic Growth Concerns in Europe

Economic growth in the Eurozone was adjusted downward to 0.2% for the second quarter, confirming worries that tight monetary policies significantly affect the region’s economy.

Germany, the largest economy in the zone, is notably impacted. This revision has led market participants to anticipate that the ECB might soon reduce interest rates by another 0.25%.

- Also read: USD/MXN Analysis – 6-September-2024

Market Reactions and Predictions

Despite the euro’s recent dip, it has risen 3.4% since July. This increase is partly due to signs of a weakening job market in the U.S., prompting speculation that the Federal Reserve may also cut rates.

This speculation grew stronger after consecutive disappointing U.S. employment reports, including the non-farm payroll data released by the Bureau of Labor Statistics in August.

Enhancing Your Financial Insight

It’s important to note how sensitive the euro is to changes in economic forecasts and central bank actions. Monitoring these indicators can provide valuable insights into potential currency movements and help make more informed financial decisions.

Conclusion: Navigating Currency Movements

The euro’s recent movements reflect broader economic trends and central bank policies in Europe and the U.S. As new economic data emerges, investors adjust their expectations for future interest rates, directly impacting currency values.

Keeping an eye on these developments can be crucial for anyone involved in financial planning or investment.

Comments are closed.