EURUSD Falls Below $1.094 on ECB Rate Cut Talk

This October, the Euro continued to weaken, reaching close to the $1.092 level. This marks a continuation of a downward trend, hitting a two-month low.

This decline is mainly due to widespread expectations that the European Central Bank (ECB) will soon implement multiple rate cuts to boost economic growth. This expectation contrasts with predictions that the U.S. Federal Reserve might not ease its monetary policy.

Economic Indicators Signal Challenges in the Eurozone

Recent data reveal a drop in Eurozone inflation to below 2% in September, signaling a decrease in price pressures. Moreover, the latest Purchasing Managers’ Index (PMI) indicates that the overall Eurozone and individual member countries are experiencing economic slowdowns.

Given these factors, the ECB is expected to reduce its main interest rates by 25 basis points in the coming week.

Fiscal Worries in France Affect the Euro

Fiscal stability concerns in France have added to the Euro’s troubles. These issues raise doubts about the creditworthiness of the bloc’s second-largest economy and have led to increased speculation about the country’s debt levels.

This situation could potentially impact the economic stability of the entire Eurozone.

U.S. Labor Market Strengthens, Fed Decisions Awaited

In contrast, the U.S. is showing signs of a robust labor market, diminishing the need for the Federal Reserve to make significant rate cuts. The market is now looking forward to the upcoming U.S. inflation report, which will provide further clues about the Fed’s future monetary policy decisions.

- Also read: USD/MXN Bullish Amid Mexican Inflation Falls

EURUSD Analysis – 10-October-2024

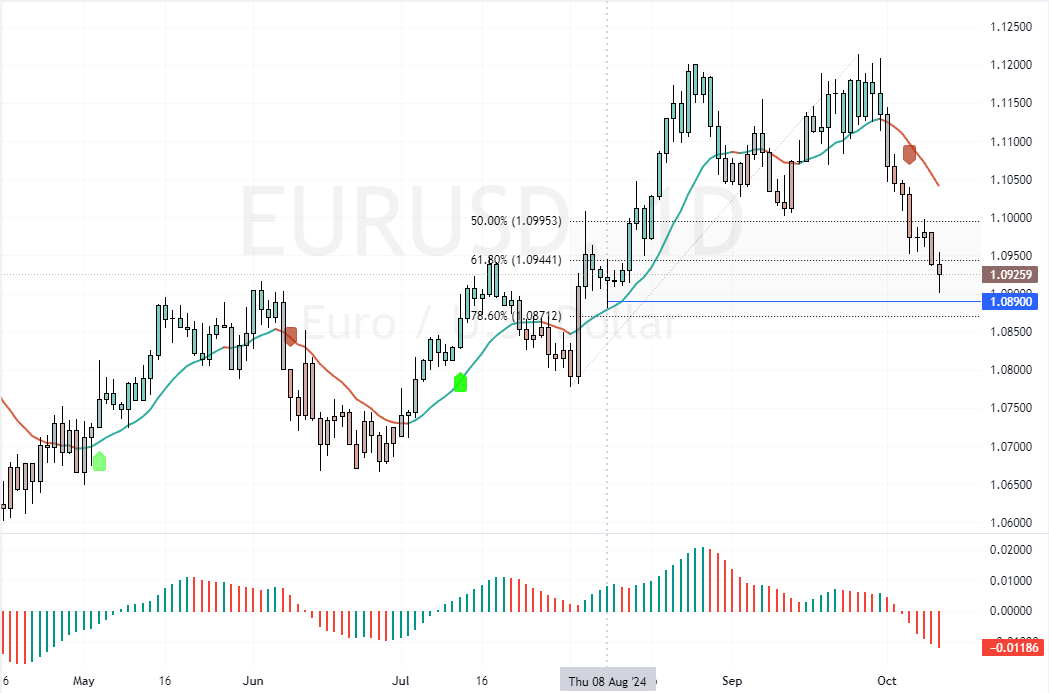

FxNews—The currency pair trades in a robust bear market and broke below the critical 61.8% Fibonacci retracement level at 1.094 in today’s trading session. As of this writing, the Euro trades at approximately 1.0925, pulling back from the August 8 low at $1.089.

From a technical standpoint, the EUR/USD is in a bear market since it trades below the 61.8% Fibonacci. Furthermore, the downtrend will likely resume if the $1.095 (61).8% Fibo) holds as resistance. In this scenario, the next bearish target could be the 78.6% Fibonacci retracement level at $1.087.

Please note that the bear market should be invalidated if the EUR/USD price exceeds $1.094.

Comments are closed.