AUDUSD Consolidates as Australia Inflation Falls to 4%

The Australian dollar is valued at around $0.674, marking its lowest point in almost a month. This shift in value reflects investors adjusting their expectations for potential interest rate cuts by the U.S. Federal Reserve following recent developments in U.S. employment data and the Federal Open Market Committee (FOMC) minutes.

How China Affects Australia’s Currency Value

China’s absence of new economic stimulus has negatively impacted the Australian dollar. Given Australia’s significant financial ties with China, the Australian dollar often mirrors the economic performance of the Chinese yuan. This relationship underscores Australia’s dependency on China’s economic climate.

Australia’s Inflation Falls to 4%

A recent private survey in Australia indicated a drop in consumer inflation expectations to the lowest in three years, settling at 4% in October. This decrease suggests a shift in how consumers perceive future pricing pressures within the economy.

RBA Meeting: Interest Rates Unchanged

During the latest Reserve Bank of Australia (RBA) meeting, board members explored various scenarios that could decrease or increase interest rates. These discussions took place in a context of significant economic unpredictability.

The RBA ultimately decided that maintaining the current cash rate would most effectively balance the potential risks concerning inflation and job market stability.

AUD/USD Analysis – 10-October-2024

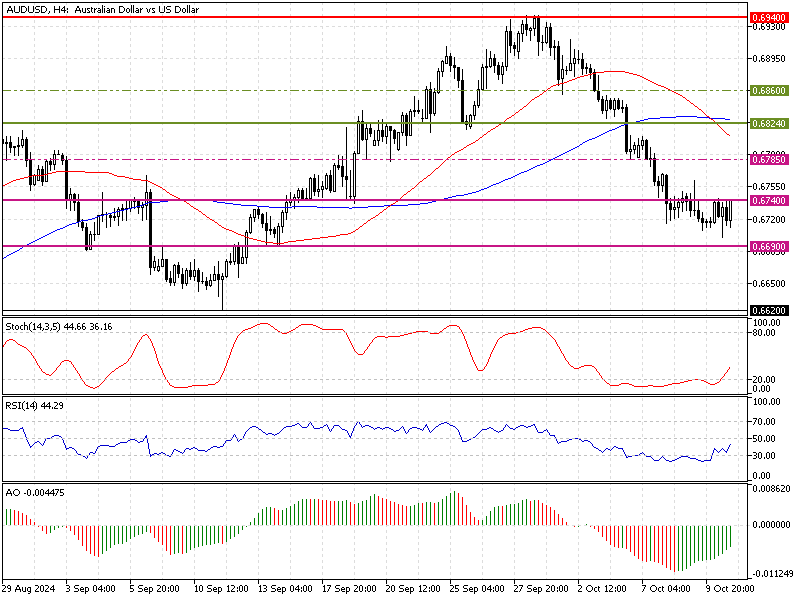

FxNews—As of this writing, the AUD/USD currency pair is testing $0.674 as resistance. Meanwhile, the technical indicators suggest the primary trend is bearish, but the U.S. dollar is overpriced in the short term against the Aussie.

- The Awesome oscillator histogram is green, approaching the signal line from below.

- The Stochastic oscillator stepped away from the oversold territory, depicting 36 in the description and rising.

- The Relative strength index, or RSI 14 value, increases, recording 44, on its way to crossing above the median line.

AUD/USD Price Forecast

The immediate resistance is at $0.674. From a technical perspective, a new consolidation phase could start if the bulls close above this mark. If this scenario unfolds, the consolidation phase can potentially extend to the next resistance level at $0.678.

Conversely, a break below the immediate support at $0.669 invalidates the short-term bullish outlook. In this scenario, a new bearish wave with a $0.662 target will likely begin.

Comments are closed.