GBPUSD Fundamental Analysis – January-19-2024

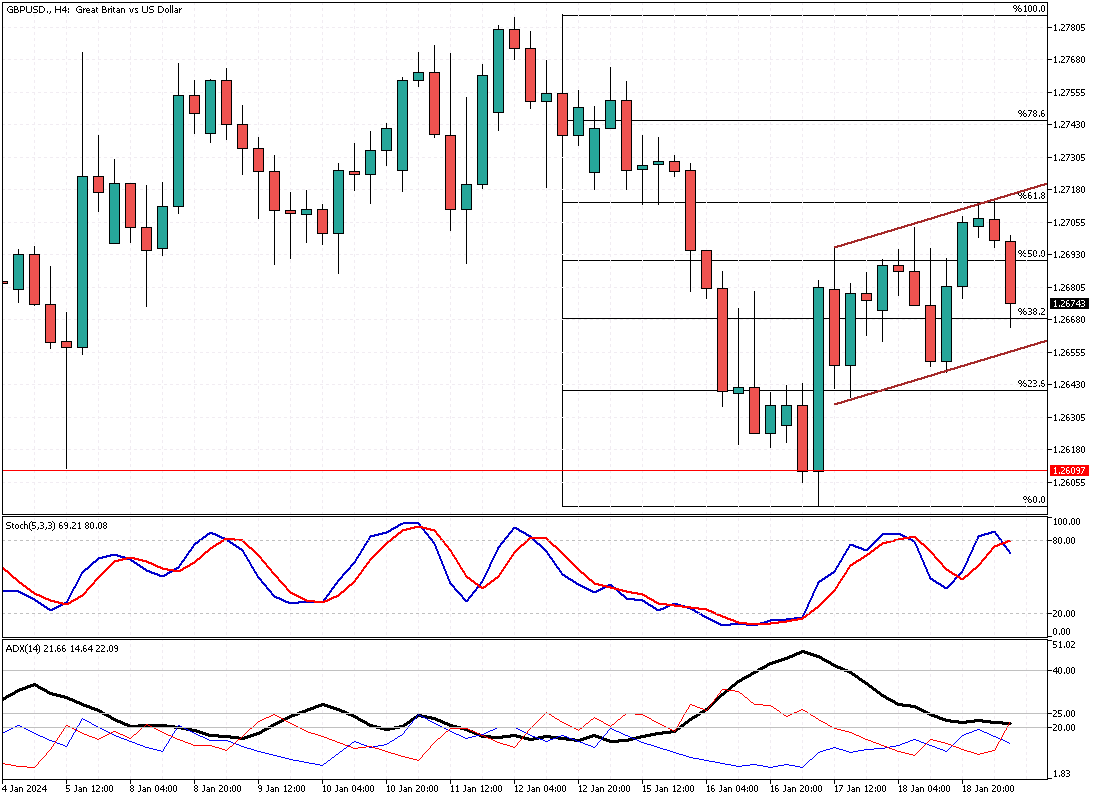

The GBPUSD pair recently experienced a dip, falling below the $1.27 mark. This movement in the currency market can be attributed to a range of economic data releases, which are closely watched for their potential impact on the Bank of England’s future monetary policy decisions. Among these releases, the UK retail sales data for December was particularly striking, showing a 3.2% decrease in volumes. This decline, the most significant since January 2021, exceeded the predicted 0.5% fall, indicating a potential slide into recession for the UK economy in the fourth quarter.

Earlier in the week, the Consumer Price Index (CPI) report presented another unexpected development. Britain’s inflation rate climbed to 4%, surpassing forecasts. The core inflation rate, which excludes volatile items like food and energy, remained constant at 5.1%, still above the general consensus. These figures suggest persistent inflationary pressures within the UK economy, complicating the Bank of England’s task of balancing inflation control with economic growth.

Additionally, the UK jobs report provided insights into the labor market, revealing a notable slowdown in wage growth. This trend, coupled with a continuous decline in job vacancies, paints a picture of a potentially cooling labor market. These factors together – retail sales contraction, rising inflation, and shifts in the labor market – form a complex backdrop for the Bank of England’s monetary policy decisions.

Comments are closed.