AUDUSD Fundamental Analysis – January-19-2024

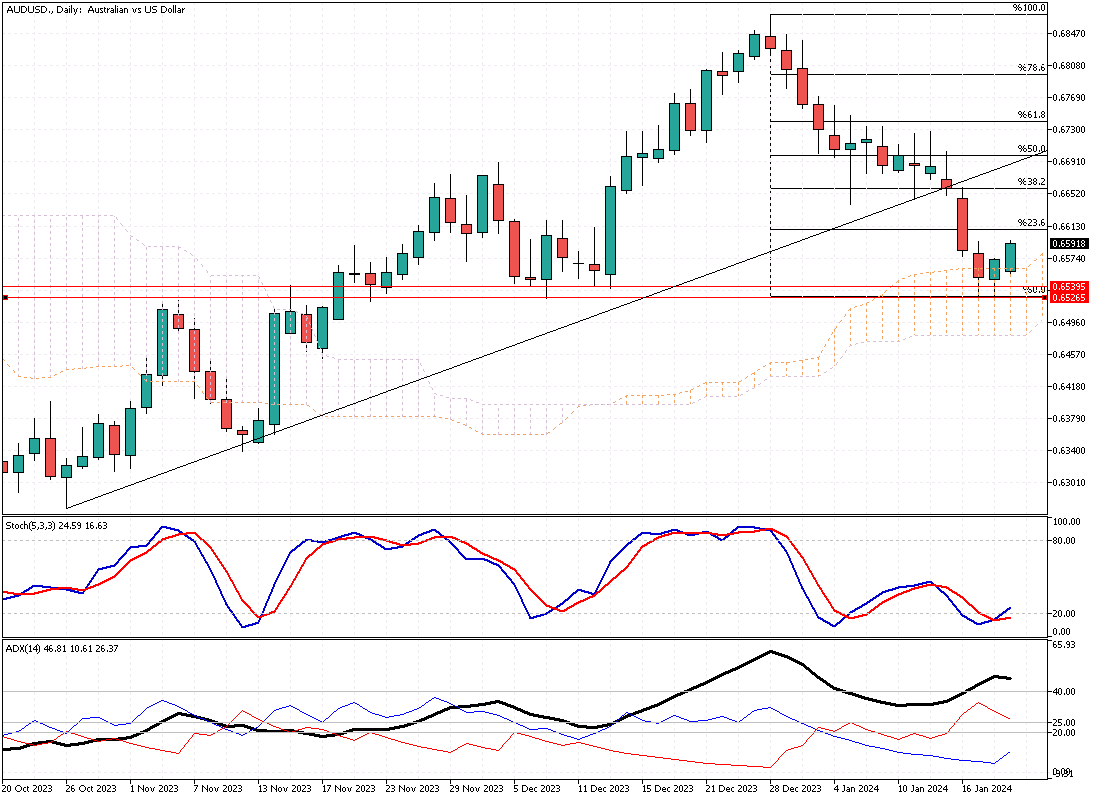

The AUDUSD currency pair has recently stabilized around the $0.655 mark, yet it hovers near its lowest point in almost two months. This trend in the currency market can be attributed to a combination of strong economic indicators from the United States and firm stances taken by Federal Reserve officials, which have collectively dampened the anticipation of interest rate cuts.

These external factors significantly influence the Australian dollar’s valuation due to the close economic ties and currency comparisons between Australia and the United States.

On the domestic front, investors are closely analyzing the latest employment data from Australia. The country’s unemployment rate was reported at 3.9% for December, consistent for the second consecutive month. This figure represents the highest unemployment rate Australia has faced since May 2022. The steady unemployment rate is an important economic indicator, reflecting the stability of the job market and, by extension, the broader financial health.

Given these employment statistics, there’s a growing consensus that the Reserve Bank of Australia (RBA) might halt further policy tightening. Analysts and investors are increasingly expecting the RBA to maintain the current interest rates at its upcoming February meeting. This outlook is significant as it suggests a shift from the previously more aggressive rate adjustments aimed at controlling inflation and stimulating economic growth.

Comments are closed.