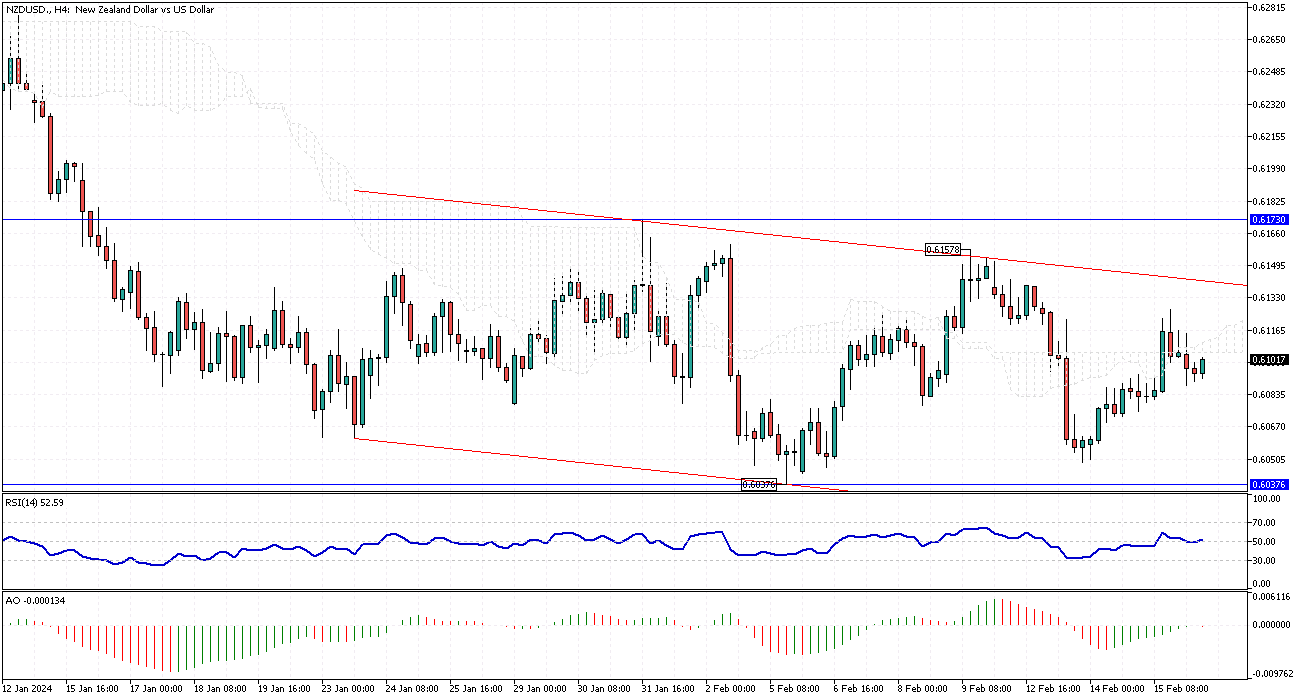

NZDUSD Fundamental Analysis – February-16-2024

NZDUSD Analysis – The New Zealand dollar has been hovering around the $0.61 mark, demonstrating a period of equilibrium amidst recent comments from Reserve Bank of New Zealand (RBNZ) Governor Adrian Orr. With Orr’s remarks providing limited guidance on future monetary policy directions, investors and analysts have been left to parse the implications for interest rate movements. Orr highlighted the ongoing need to address core inflation pressures while cautioning against the potential pitfalls of excessive policy tightening.

This balanced approach has led to a recalibration of market expectations, with the likelihood of an imminent rate hike by the RBNZ this month being reassessed and the anticipation of further rate increases within the year dipping below the 50% threshold. This shift represents a significant moderation in expectations compared to the previous week’s more aggressive outlook.

NZDUSD Fundamental Analysis

Recent data has shed light on the evolving inflationary landscape in New Zealand, revealing a notable decline in inflation expectations to their lowest point in more than two years for the first quarter. This development suggests that the RBNZ’s prior rate adjustments have been instrumental in tempering the inflationary surge, marking a pivotal moment in the country’s economic management.

The effectiveness of these policy measures in stabilizing prices underscores the delicate balance central banks must strike in navigating the inflation-growth nexus. As New Zealand grapples with these economic challenges, the global context remains ever-relevant, with external factors such as US economic indicators playing a role in shaping expectations and strategies.

External Influences and the Kiwi’s Resilience

The dynamics of the New Zealand dollar have also been influenced by international economic shifts, mainly through its interaction with the US dollar. A dampening of US retail sales figures has sparked speculation around potential rate cuts by the Federal Reserve, contributing to a weaker greenback.

This scenario has provided a backdrop against which the Kiwi has found some support, highlighting the interconnectedness of global financial markets and the impact of foreign economic developments on domestic currencies. As New Zealand continues to navigate its monetary policy path, the interplay between domestic economic indicators and international economic trends will remain critical in shaping the currency’s trajectory and broader economic outlook.

Comments are closed.