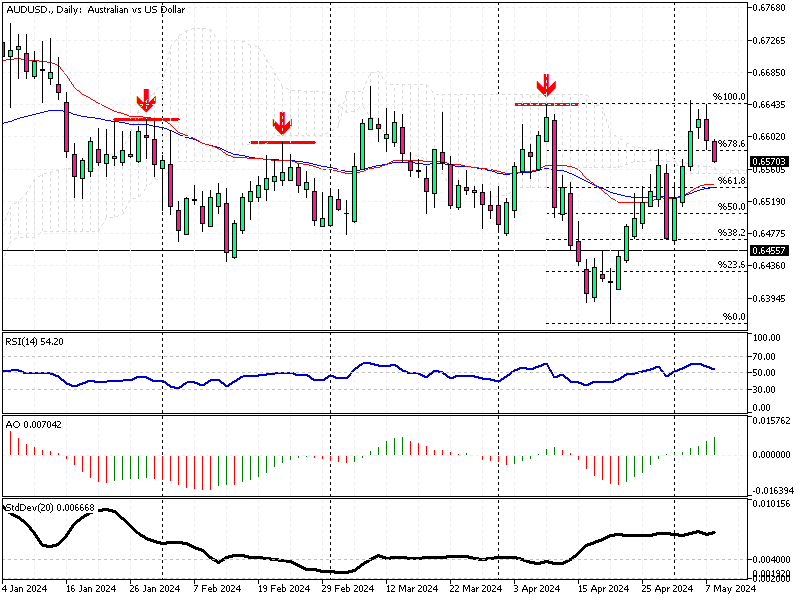

AUDUSD – Aussie Dollar Drops After RBA Decision

The Australian dollar experienced a significant drop, falling below the $0.66 mark (AUDUSD), after the Reserve Bank of Australia (RBA) opted to keep its cash rate fixed at 4.35%.

Despite market expectations, the central bank’s latest announcement lacked a hawkish tone, leading to a rapid depreciation from its recent two-month highs. This decision marks the fourth consecutive rate hold since the last increase in November.

Aussie Dollar Drops After RBA Decision

Investors were eyeing a more aggressive stance from the RBA, particularly with recent inflation trends. While Australia’s inflation rate decreased to 3.6% in the first quarter, down from 4.1%, it still exceeded the projected 3.4%. This slowdown represents the fifth consecutive quarter of declining inflation rates, yet the persistence of higher-than-expected inflation figures is troubling.

Additionally, the monthly CPI indicator unexpectedly rose to 3.5% in March, indicating that inflation pressures remain resilient.

RBA’s Cautious Stance and Market Implications

The RBA’s decision to maintain its current rate, alongside its commitment to keeping future decisions open (“not ruling anything in or out”), reflects a cautious approach amid uncertain economic signals.

This implies a need for vigilance for forex traders and investors. The central bank’s acknowledgment of stalled progress on inflation suggests potential volatility and unpredictability in the forex markets, particularly concerning the Australian dollar. Investors should closely monitor upcoming economic data, which will likely influence the RBA’s future rate decisions and forex market dynamics.

Comments are closed.