AUDUSD Fundamental Analysis – 10-June-2024

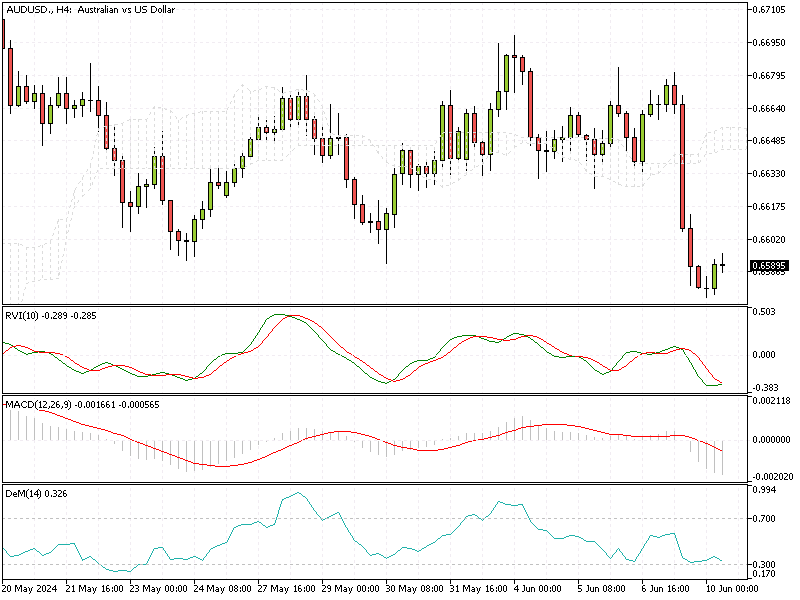

AUD/USD—The Australian dollar has slipped below $0.66, hitting its lowest point in four weeks. This drop follows the US dollar’s rise, driven by robust US job data that lessens the likelihood of the Federal Reserve cutting interest rates twice this year. The upcoming Federal Reserve policy decision and key US inflation data have made investors more cautious.

Australia Records 0.1% Economic Growth

Recently, Australia reported a modest economic growth of 0.1% for the first quarter, a slowdown from the 0.3% growth seen in the previous quarter and below the anticipated 0.2%. Despite this, the Reserve Bank of Australia (RBA) is not expected to lower interest rates this year.

RBA’s Michele Bullock on Inflation and Rates

RBA Governor Michele Bullock emphasized the bank’s readiness to act if inflation persists but noted that the current risks to inflation and interest rates are balanced. She also highlighted that the labor market shows signs of easing and acknowledged that the latest GDP figures were disappointing.

Summary

For investors and analysts, these developments signal a period of economic uncertainty. The weakening Australian dollar reflects broader global economic influences, particularly the strength of the US economy. As such, monitoring both Australian and US economic indicators will be crucial in anticipating market movements and making informed financial decisions.

Comments are closed.