AUDUSD Fundamental Analysis – 15-July-2024

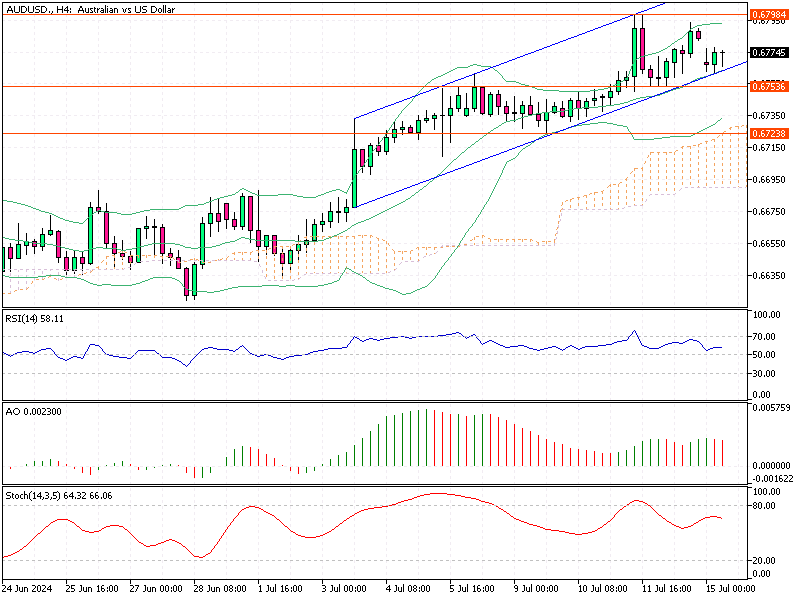

The Australian dollar recently stalled around $0.677 (AUD/USD), primarily influenced by the strengthening of the US dollar. This boost in the US dollar came as a reaction to a safe-haven bid triggered by an assassination attempt on former US President Donald Trump.

Despite this, the Australian dollar (often called the “Aussie”) has maintained proximity to its most robust levels since early January. This resilience is mainly attributed to the cooling of US inflation, strengthening market expectations for a Federal Reserve rate cut in September.

RBA Unlikely to Cut Rates in 2024

On the other hand, the Reserve Bank of Australia (RBA) is anticipated to lag in the global rate-cutting cycle due to ongoing domestic inflation pressures. Despite some speculation, the market sees only a 20% chance that the RBA might further tighten its policy in August, effectively ruling out any potential rate cuts within the year.

Aussie Dollar Soars Near Two-Year Highs

Furthermore, the Australian dollar has reached near two-year highs against the New Zealand dollar (NZD), driven by the Reserve Bank of New Zealand’s (RBNZ) signaling of an earlier rate cut in response to their inflation outlook. This divergence in central bank policies has provided a relative boost to the Aussie.

However, it’s not all upward momentum for the Australian dollar. It has recently retreated sharply from its 33-year highs against the Japanese yen. This significant pullback is suspected to result from the intervention of the Japanese authorities to stabilize their currency.

AUDUSD Fundamental Analysis – 15-July-2024

In summary, the current economic landscape is a complex interplay of various factors influencing the Australian dollar. The recent events surrounding former US President Donald Trump have injected volatility into the currency markets, favoring the US dollar. However, the longer-term outlook seems to favor the Australian dollar, supported by expectations of a Federal Reserve rate cut amid cooling US inflation.

For investors and market watchers, this scenario presents a mixed bag. While the Australian dollar shows strength against currencies like the NZD, driven by differing monetary policies, it faces headwinds against the yen, likely due to strategic interventions.

In the future, close attention should be paid to the actions and signals from the RBA and other major central banks. Persistent domestic inflation in Australia might delay rate cuts, maintaining a degree of strength in the Aussie. Conversely, global economic uncertainties and geopolitical events could continue to inject volatility, affecting short-term currency movements.

Understanding these dynamics is crucial for making informed investment decisions in the forex market. As always, staying updated with the latest economic data and central bank announcements will be vital in navigating these turbulent waters.

Comments are closed.