AUDUSD Fundamental Analysis – 20-June-2024

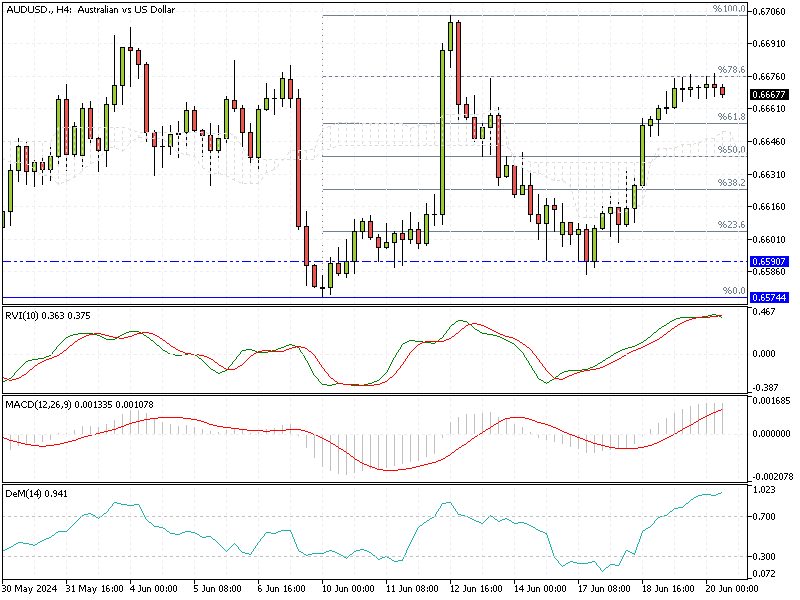

AUD/USD—The Australian dollar has recently gained value, surpassing $0.666. This rebound follows a period of decline, driven by the Reserve Bank of Australia’s (RBA) assertive stance on inflation during a recent press conference.

RBA Governor Michele Bullock highlighted that the board considered raising interest rates in June, though they ultimately chose to keep the cash rate steady at 4.35% for the fifth consecutive meeting. Notably, the idea of a rate cut was not entertained.

Market Reassesses RBA Rate Cut Chances

This hawkish sentiment has led markets to reassess their expectations. Previously, there was a 64% chance that the RBA would cut rates by December, but this has now dropped to 25%. The likelihood of any rate reduction has been pushed back to April next year. This shift underscores the RBA’s focus on combating inflation, reflecting a cautious approach toward monetary easing.

RBNZ Predicts Faster Inflation Decline

In contrast, the Reserve Bank of New Zealand (RBNZ) projects a more dovish outlook. The RBNZ’s chief economist noted that inflation might decline more swiftly than anticipated over the medium term. This suggests New Zealand’s monetary policy could become more accommodative sooner than Australia’s.

Summary

For investors and economic observers, these developments highlight the nuanced differences between the Australian and New Zealand economies. Understanding these central bank positions can guide informed decisions on forex trading and investment strategy.

Comments are closed.