AUDUSD Fundamental Analysis – 3-July-2024

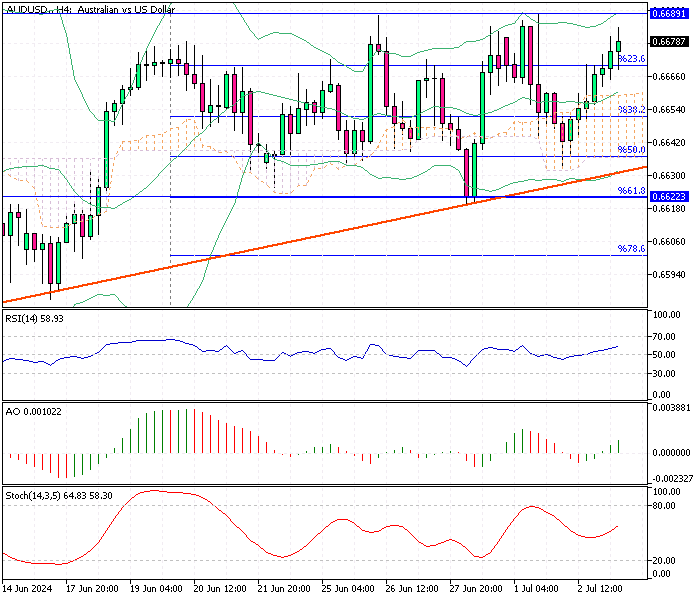

AUD/USD—The Australian dollar (AUD) has been making significant gains, recently approaching $0.668, its highest in three weeks. This appreciation comes as the US dollar weakens following comments from Federal Reserve Chair Jerome Powell, who highlighted a shift toward a disinflationary trend.

However, Powell emphasized the need for more confidence in the inflation outlook before considering interest rate cuts.

Fed vs RBA: Diverging Inflation Strategies

Jerome Powell’s remarks reflect a cautious optimism in the US economic landscape, suggesting that while inflation pressures may be easing, the Federal Reserve remains cautious. This careful stance contrasts sharply with the Reserve Bank of Australia (RBA), whose recent June policy meeting minutes underscored a vigilant approach to inflation.

The RBA minutes revealed that Australian policymakers are acutely aware of the potential for rising prices, indicating that a significant increase in inflation could necessitate higher interest rates. This divergence in central bank policies is critical for understanding the current dynamics of the AUD/USD exchange rate.

Australian Rate Hike Odds Rise in August

The market sentiment reflects this divergence. While the probability of an RBA rate hike in August stands at one in three, markets have vastly discounted the possibility of a rate cut in Australia for this year. This suggests that traders and investors are betting on continued monetary tightening in Australia, in stark contrast to the more dovish outlook from the US Federal Reserve.

Australia’s Retail Sales Surge to 4-Month High

Recent economic data from Australia has been positive, supporting the bullish sentiment toward the Australian dollar. Australia’s retail sales growth reached a four-month high in May, indicating robust consumer spending. This is a significant indicator as retail solid sales often reflect healthy economic activity and consumer confidence.

Moreover, private sector activity in Australia remained expansionary in June. Expansion in the private sector is a crucial indicator of economic health, signaling that businesses are growing and contributing positively to the economy.

AUDUSD Fundamental Analysis – 3-July-2024

Given these factors, the outlook for the AUD/USD exchange rate appears to favor the Australian dollar, at least in the short to medium term. The robust economic data and the likelihood of further rate hikes by the RBA provide a strong foundation for the Australian dollar’s strength. On the other hand, the Federal Reserve’s cautious approach suggests that the US dollar may remain under pressure if the expected disinflationary trend continues without the need for rate hikes.

Investors and traders should closely monitor upcoming economic data and central bank communications. In particular, any signs of accelerating inflation in Australia could reinforce the case for RBA rate hikes, further boosting the AUD. Conversely, if US inflation data shows unexpected increases, it could prompt a reassessment of the Fed’s dovish stance, potentially reversing some of the Australian dollar’s recent gains.

Final Words

In conclusion, the current rise of the Australian dollar against the US dollar can be attributed to diverging central bank policies and positive economic data from Australia. While the Federal Reserve adopts a wait-and-see approach towards disinflation, the RBA remains vigilant against inflation risks, underpinning the AUD’s strength.

Investors should stay informed about economic indicators and central bank statements to navigate the currency market effectively. Understanding these dynamics can help make more informed decisions and anticipate potential market movements.

Comments are closed.