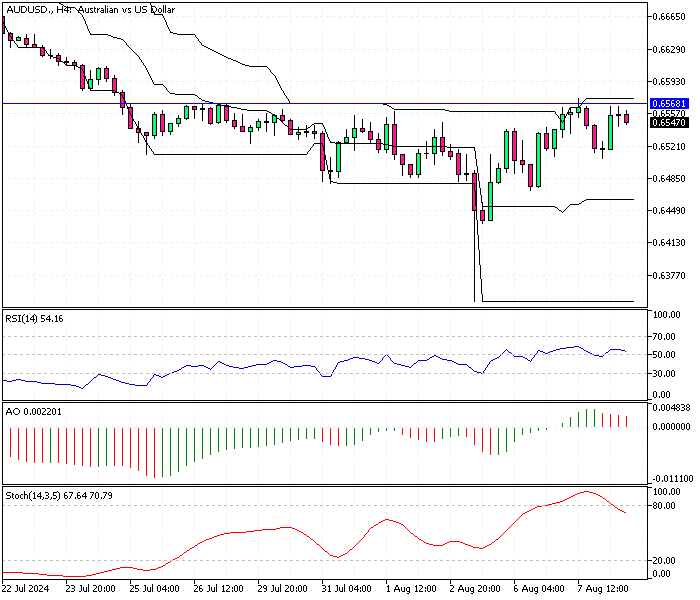

AUDUSD Fundamental Analysis – 8-August-2024

The Australian dollar rose to about $0.654 (AUD/USD), reaching its highest point in two weeks. This increase followed a statement by Reserve Bank of Australia (RBA) Governor Michele Bullock. She emphasized that the central bank is prepared to raise interest rates again to control inflation.

Economic Outlook and Inflation Concerns

Governor Bullock highlighted the uncertain economic future of Australia and the need for the RBA to remain alert to potential inflation risks. Despite keeping the cash rate steady at 4.35% for the sixth consecutive meeting, the central bank signaled that inflation is still too high and ruled out any near-term rate cuts.

Domestic Economic Factors

The RBA noted a positive outlook for domestic demand, driven by increased public spending and a rebound in household consumption. These factors contribute to the country’s stronger economic expectations.

- Also Read: GBP/USD Fundamental Analysis – 8-August-2024

External Influences on the Australian Dollar

Additionally, the Australian dollar received support from expectations that the US Federal Reserve might cut interest rates more aggressively in the coming months due to signs of economic weakness in the United States. This external factor also played a role in boosting the value of the Australian dollar.

By staying vigilant and prepared to act against inflation, the RBA aims to navigate the uncertain economic landscape while balancing domestic and international influences.

Comments are closed.