AUDUSD Fundamental Analysis – 8-July-2024

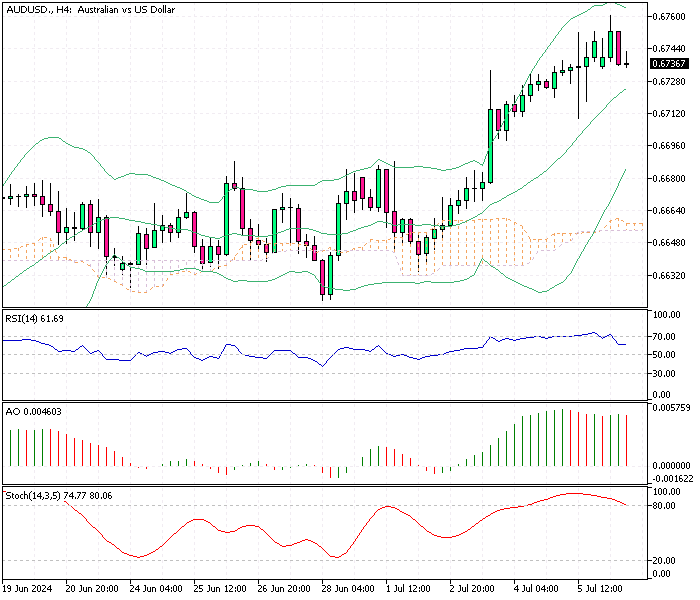

The Australian dollar has recently appreciated beyond $0.675 (AUD/USD), reaching fresh six-month highs. This upward movement is fueled by several economic factors and market expectations, primarily revolving around the Reserve Bank of Australia’s (RBA) potential actions regarding interest rates.

Reserve Bank of Australia’s Interest Rate Dynamics

The RBA has been a central figure in the appreciation of the AUD. Market participants speculate that the RBA might not follow the global trend of rate cuts and could even consider raising interest rates further.

This speculation is driven by strong inflation data for May, indicating that the RBA might need to implement tighter monetary policies to control inflation.

Currently, the markets have priced in an almost even chance that the RBA will hike rates at its next meeting in August. This potential rate hike is significant because it suggests that the RBA is prioritizing inflation control over stimulating economic growth through lower interest rates.

Additionally, the market has dismissed the possibility of a rate cut this year, reinforcing the expectations of a tight monetary stance.

Impact of High Domestic Yields

Australia’s high domestic yields contribute to the AUD’s strength. High yields make Australian assets more attractive to foreign investors seeking stable returns. Investors often seek safer havens to park their capital in political uncertainties in central US and European economies.

Australia’s relatively stable political environment and higher yields offer such a refuge, attracting foreign capital and boosting the demand for the AUD.

Comparison with the US Dollar

The AUD’s gain against the US dollar (USD) can also be attributed to the US economic conditions. The US recently reported soft economic data supporting a dovish Federal Reserve (Fed) monetary policy outlook.

A dovish policy stance typically means that the Fed is more likely to lower interest rates or maintain them at low levels to stimulate economic growth. Lower interest rates in the US make the USD less attractive to investors, leading to a relative appreciation of other currencies like the AUD.

Relationship with the New Zealand Dollar

Despite its strength against the USD, the AUD has lost some ground to the New Zealand dollar (NZD). This movement is linked to the upcoming policy decision by the Reserve Bank of New Zealand (RBNZ).

Investors are closely watching the RBNZ’s actions, as any hawkish move—such as raising interest rates—could strengthen the NZD further against the AUD.

AUDUSD Fundamental Analysis – 8-July-2024

Looking ahead, the trajectory of the AUD will largely depend on the RBA’s decisions and the broader global economic environment. If the RBA raises rates in August, we could see the AUD strengthening further. Conversely, any signs of a rate cut or softer inflation data could temper these gains.

Moreover, the ongoing political uncertainties in the US and Europe will continue to play a crucial role. If these uncertainties persist, they could keep foreign capital flowing into Australian assets, further supporting the AUD. Conversely, any resolution of these uncertainties might reverse this trend.

Final Word

In summary, the Australian dollar’s recent appreciation results from strong domestic economic indicators and global financial dynamics. By monitoring the RBA’s policies and the global economic landscape, investors can better understand and anticipate the future movements of the AUD, making more informed decisions in this volatile market environment.

Comments are closed.