AUDUSD Fundamental Analysis: Aussie Dollar Peaks

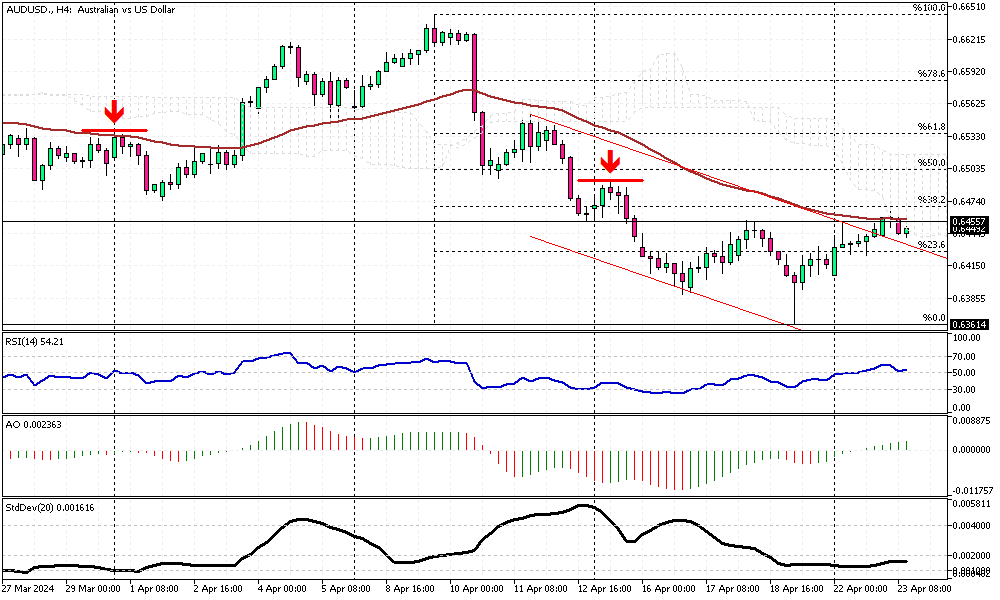

AUDUSD Fundamental Analysis – The Australian dollar recently reached a one-week high, trading around $0.645. This surge comes as investors digest April’s robust purchasing managers index (PMI) reports. These indices, a gauge of economic health in manufacturing and services sectors, have fueled optimism about Australia’s financial direction.

Aussie Dollar Peaks: Economic Growth Signals

April’s data revealed that Australia’s private sector has experienced its most significant growth spurt in two years. Manufacturing is on the brink of expansion, and the services sector has been growing for three consecutive months. This positive trend in key sectors hints at sustained economic momentum despite global uncertainties.

Interest Rate Speculations

Amidst these developments, there’s a buzz around the Reserve Bank of Australia’s (RBA) next moves. The strong economic indicators could persuade the RBA to maintain higher interest rates to curb inflation. Some market analysts are even predicting a possible rate hike in the latter half of 2024, should this upward trend persist.

Inflation and Global Influence

Investors are now keenly awaiting domestic inflation figures due later this week, which could provide more clues about future monetary policies. Additionally, the Australian dollar benefits from international factors, such as diminished concerns over potential conflicts in the Middle East, further boosting investor confidence in the Aussie.

Comments are closed.