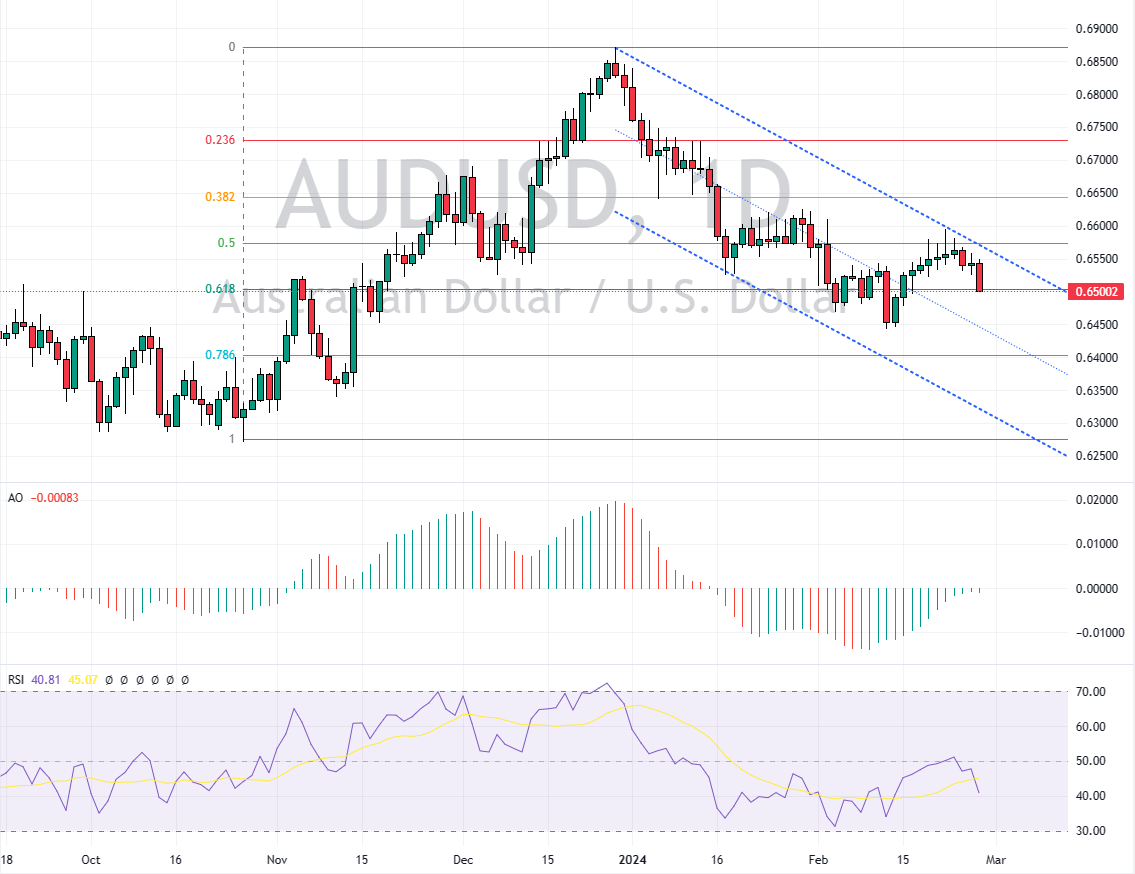

AUDUSD Fundamental Analysis – February-28-2024

AUDUSD Fundamental Analysis – The value of the Australian dollar dropped significantly, reaching approximately $0.652. This decrease marked its weakest point in the past week. This shift resulted from market reactions to unexpectedly low inflation data within the country. Instead of rising, inflation rates have failed to meet the anticipated figures.

AUDUSD Fundamental Analysis: Inflation Trends

Recent statistics unveiled that Australia’s monthly inflation rate, measured by the Consumer Price Index (CPI), remained steady. It persisted at 3.4% in January, a figure mirroring that of December. This rate is notably lower than the predicted 3.6%, highlighting a deviation from expected economic conditions—such a steadiness at a two-year low point towards a cooling inflationary trend, diverging from prior forecasts.

Central Bank’s Monetary Stance

The Reserve Bank of Australia (RBA) has been spotlighted following its latest monetary policy discussions. In their previous session, the board discussed the prospect of increasing interest rates in their February gathering. However, they opted to keep the rates unchanged. This decision was grounded in the emerging evidence of subsiding inflation pressures.

Furthermore, the RBA mentioned its approach of waiting for more definitive signs that inflation is aligning back with its target. This cautious stance underscores the central bank’s commitment to ensuring price stability while allowing for additional economic assessments before implementing further rate hikes.

Comments are closed.