AUDUSD Fundamental Analysis – May-29-2024

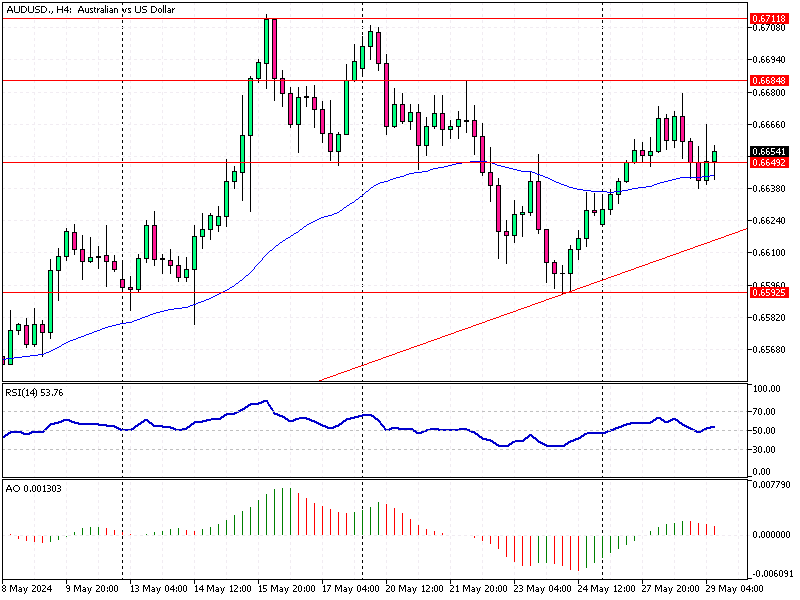

AUD/USD—The Australian dollar stabilized around $0.665 as investors digested stronger-than-expected inflation figures. In April, Australia’s inflation rate accelerated to 3.6% year-on-year, up from 3.5% in March. This increase defied market expectations of a slowdown to 3.4% and marked the highest inflation rate since November.

AUDUSD Fundamental Analysis – May-29-2024

With inflation rising, markets now expect the Reserve Bank of Australia (RBA) to maintain higher interest rates for longer. A rate cut is not fully anticipated until May next year. The latest RBA meeting minutes revealed that the board had considered raising rates in May but ultimately chose to maintain a steady policy.

The board noted that it was difficult to rule out future changes in the cash rate, especially given the increasing risk of inflation staying above the target for an extended period.

This economic scenario suggests a period of cautious financial planning for investors and consumers. Higher inflation can erode purchasing power, while steady interest rates might affect borrowing costs. Monitoring future RBA announcements and inflation trends will be crucial for making informed financial decisions. (source Bloomberg)

Conclusion

Understanding these economic indicators can help individuals and businesses better navigate the current economic landscape, ensuring they are well-prepared for potential market changes. Stay informed to make sound financial choices in this dynamic economic environment.

Comments are closed.