EURUSD Climbs as Inflation Surprises – ECB Rate Cuts Expected

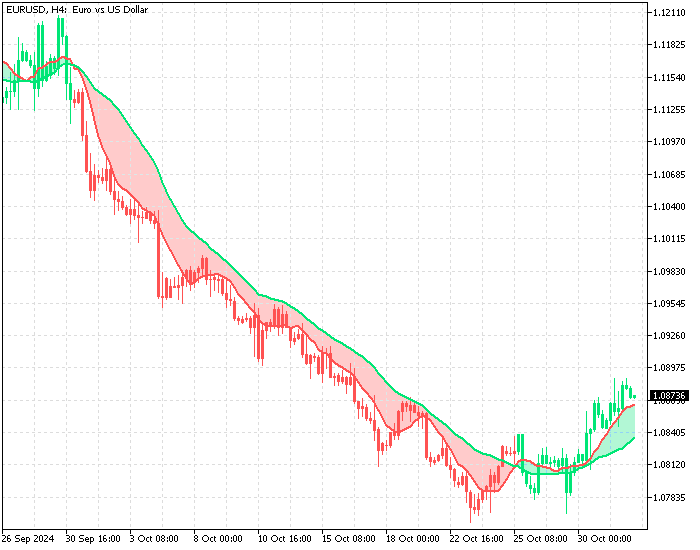

The EUR/USD rose to a two-week high of $1.087 after inflation in the Euro Area exceeded expectations, hinting that the European Central Bank (ECB) might opt for smaller, more measured interest rate cuts.

The inflation rate climbed to 2%, up from a previous low of 1.7% and surpassing predictions of 1.9%. Despite expectations for a drop, the core inflation rate stayed steady at 2.7%.

Eurozone Economy Surges in Q3 with Unexpected Growth

Earlier in the week, the Eurozone reported better-than-expected economic performance, further boosting confidence. The region’s economy grew by 0.4% in the third quarter, doubling the rate from the second quarter and topping the expected 0.2% increase.

Notably, Germany dodged a recession with a growth of 0.2%, and both France and Spain exceeded growth forecasts. However, Italy’s economy did not grow.

Market participants now fully expect the ECB to reduce its deposit rate by 25 basis points in December, the fourth cut following reductions in October, September, and June. Despite these developments, the Euro declined 2.4% in October.

Comments are closed.