EURUSD Fundamental Analysis – 10-June-2024

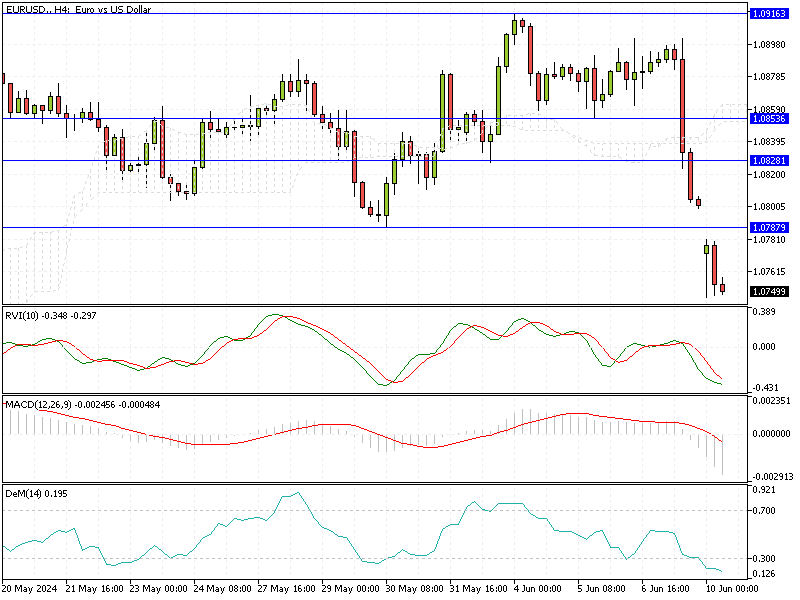

EUR/USD—The euro recently fell below $1.074, marking a one-month low, driven by political and economic factors. French President Emmanuel Macron’s call for a snap election after a significant defeat to Marine Le Pen’s National Rally party in the European Union vote has added political uncertainty, negatively affecting the euro.

This instability makes investors cautious, impacting the currency’s value.

Strong US Jobs Data Hurts Euro

Additionally, the euro faces pressure from a strengthening US dollar. Recent robust US jobs data has led traders to reduce their expectations for US interest rate cuts, anticipating a more cautious stance from the Federal Reserve in its upcoming policy meeting. A stronger dollar typically makes other currencies less attractive, further pushing down the euro.

ECB Cuts Rates After Five Years

On the European front, the European Central Bank (ECB) recently implemented its first rate cut in five years. Despite this move, the ECB remains cautious about further cuts. ECB President Christine Lagarde emphasized that future decisions will depend on economic data, highlighting the ongoing challenges of managing inflation.

The ECB predicts inflation will exceed its targets well into the following year, indicating persistent price pressures.

Comments are closed.