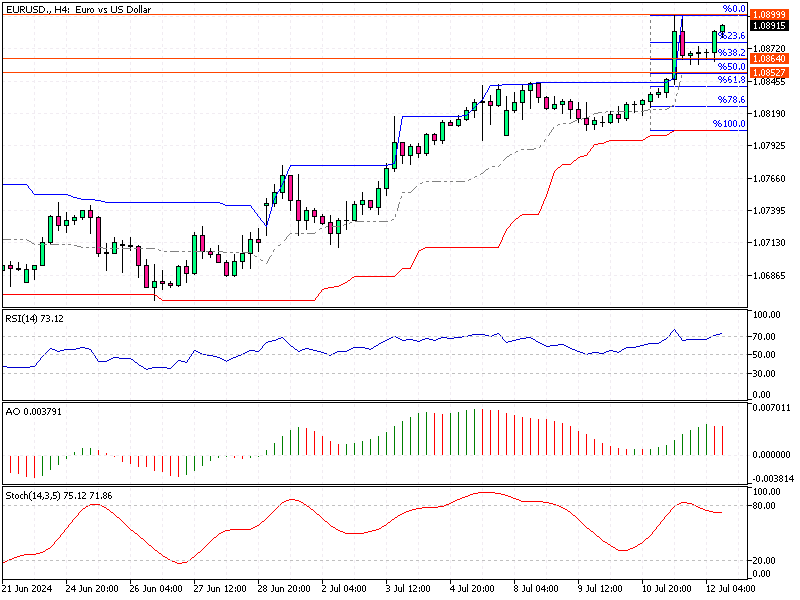

EURUSD Fundamental Analysis – 12-July-2024

The euro has surged to $1.089 (EUR/USD), marking a five-week high, primarily due to a weakening US dollar. This movement in currency value is driven by recent inflation data, which supports predictions of a Federal Reserve rate cut in September.

Understanding the Dollar’s Weakness

The US dollar has weakened following the latest inflation data. Headline inflation in the US fell to 3% in June, slightly below the anticipated 3.1%. Additionally, there was a monthly decrease of 0.1%, contrasting with the expected increase. This decline in inflation suggests that the Federal Reserve may not need to maintain its current interest rates, leading to speculation about a potential rate cut in September.

Federal Reserve and Interest Rates

The Federal Reserve, or the Fed, is the central banking system of the United States. It influences monetary policy by setting interest rates. When inflation is high, the Fed raises interest rates to cool the economy.

Conversely, as in the current scenario, the Fed may lower interest rates to stimulate economic growth when inflation is low or declining. The prospect of a rate cut weakens the dollar because lower interest rates make investments in the currency less attractive.

Euro’s Strength and European Economic Data

On the European side, the euro has strengthened due to easing inflation in Germany. German inflation dropped to 2.5% in June, confirming earlier data. This lower inflation rate suggests that the European Central Bank (ECB) might also consider a rate cut in September.

European Central Bank’s Role

The ECB is responsible for monetary policy in the Eurozone. Like the Fed, the ECB adjusts interest rates to control inflation and support economic growth. A potential rate cut by the ECB would generally weaken the euro.

However, the current strengthening of the euro indicates that the market is responding more to the dollar’s relative weakness than to expectations of ECB actions.

Political Stability in France

Another factor contributing to the rise of the euro is the easing of political risks in France. Following recent parliamentary elections, concerns about high-spending party dominance have subsided. The election results led to a legislative gridlock, reducing fears of drastic fiscal changes that could destabilize the economy. This political stability supports a stronger euro as it reduces uncertainty for investors.

EURUSD Fundamental Analysis – 12-July-2024

The currency market will closely watch upcoming inflation data and central bank decisions. If inflation continues declining in the US, the Fed will likely proceed with a rate cut, further weakening the dollar. If inflation remains low in Europe, the ECB might consider a rate cut, which could stabilize or slightly undermine the euro. Political developments in key Eurozone countries will also play a crucial role in shaping market sentiment.

Investors should stay informed about these economic indicators and central bank actions to make well-informed decisions. The interplay between inflation, interest rates, and political stability will continue to drive currency movements in the coming months.

Comments are closed.