EURUSD Fundamental Analysis – 3-July-2024

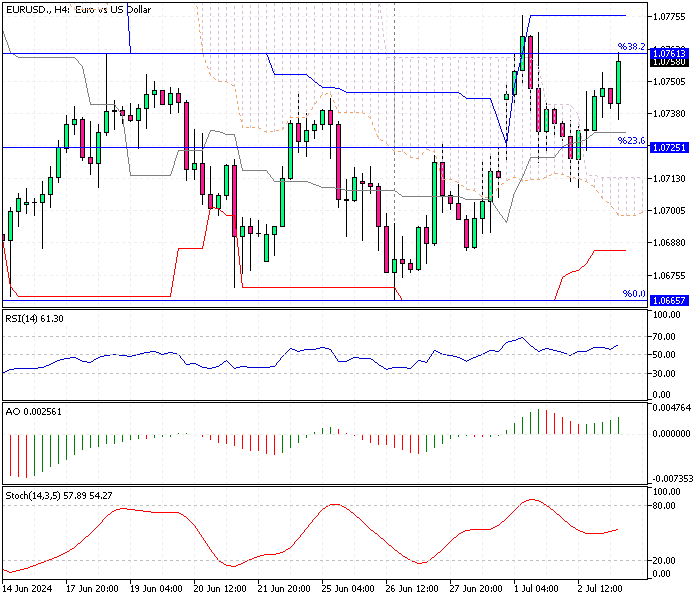

EUR/USD—The euro recently weakened to $1.076, reflecting market reactions to policymakers’ signals that more evidence is needed to confirm that inflationary pressures are under control. This shift comes from the latest economic data and political developments, contributing to market sentiment.

Let’s break down the key elements influencing the euro and the broader economic landscape to understand these movements and forecast the market’s direction.

Euro Area Inflation Eases to 2.5%

The annual inflation rate in the Euro Area eased to 2.5% in June, aligning with expectations. This is a significant development, as inflation rates are crucial indicators of economic health and directly impact monetary policy decisions. The core inflation rate, which excludes volatile items such as food and energy, remained unchanged unexpectedly.

This stability in core inflation suggests that underlying price pressures might not be as volatile as initially thought. Yet, it also implies that inflation is not decreasing as quickly as some might hope.

Different member countries have shown varied inflation trends. Germany, France, and Spain experienced a slowdown in inflation, indicating that these major economies are seeing a reduction in price pressures. However, Italy’s inflation increased to 0.9%, signaling the country faces distinct economic challenges.

ECB Maintains Caution on Inflation Threat

Despite these inflation trends, European Central Bank (ECB) President Christine Lagarde emphasized at the recent ECB Forum that the central bank does not yet have sufficient evidence to declare that the threat of inflation has passed. This cautious approach indicates that the ECB might continue its current monetary policy stance without significant changes until more concrete data supports a shift.

The ECB’s cautious outlook can contribute to market uncertainty, leading to fluctuations in the euro as investors react to potential future policy adjustments.

Far-Right Win in France Election

On the political front, the far-right National Rally party won the first round of the snap parliamentary election in France. However, their victory came with a smaller share than projected, and they are far from securing a majority. This result relieves investors, suggesting that centrist parties might retain power, maintaining political stability in one of the Euro Area’s key economies.

Political stability is often a crucial factor for investor confidence, and this outcome in France may have tempered some of the negative impacts on the euro.

EURUSD Fundamental Analysis – 3-July-2024

The euro’s easing to $1.072 reflects the combined economic and political factors currently at play. The market’s reaction to the ECB’s cautious stance on inflation and the mixed political signals from France indicates a period of uncertainty. Investors will likely remain vigilant, closely monitoring upcoming economic data and political developments to adjust their positions accordingly.

The euro may experience further fluctuations in the short term as markets react to new information. If future data shows a continued easing of inflation, particularly in core measures, the ECB might gain the confidence to adjust its monetary policy, potentially strengthening the euro. Conversely, the euro could face additional pressure if inflation remains persistent or political uncertainties intensify.

Final Words

Understanding the interplay of inflation trends, central bank policies, and political developments is crucial for making informed decisions in the current market environment. The recent easing of the euro underscores the importance of these factors and highlights the need for investors to stay informed and adaptable.

By monitoring upcoming economic indicators and political events, investors can better navigate the market’s complexities and make strategic decisions that align with their financial goals.

Comments are closed.