EURUSD Fundamental Analysis – 3-June-2024

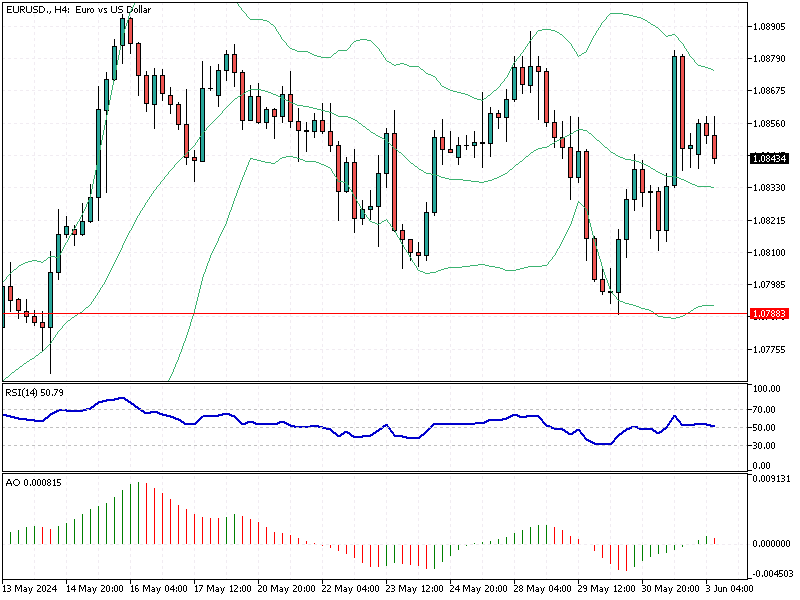

The euro reached a two-week high of $1.088 (EUR/USD), reflecting a growing gap between the European Central Bank (ECB) and the US Federal Reserve’s (Fed) monetary policies. The divergence stems from contrasting economic conditions in the Eurozone and the US.

In the Eurozone, inflation rates exceeded expectations in May, with headline inflation rising to 2.6% and core inflation hitting 2.9%. These higher-than-expected figures suggest that the ECB might limit rate cuts this year to control inflation.

US Inflation Slows as PCE Prices Rise Slightly

Conversely, the US economic data paints a different picture. Core Personal Consumption Expenditures (PCE) prices, the Fed’s preferred inflation measure, increased by only 0.2%—the slowest rate this year. This slowdown hints that inflation may be aligning with the Fed’s target. Personal spending and income growth in the US have decelerated, indicating a less robust economy than previously thought.

Conclusion

This contrast in economic indicators suggests that while the ECB might adopt a more cautious approach with rate cuts, the Fed could consider less restrictive policies. For investors and policymakers, these developments underscore the importance of staying informed about inflation trends and monetary policy shifts, as they have significant implications for currency values and economic stability.

Comments are closed.