EURUSD Fundamental Analysis – 30-July-2024

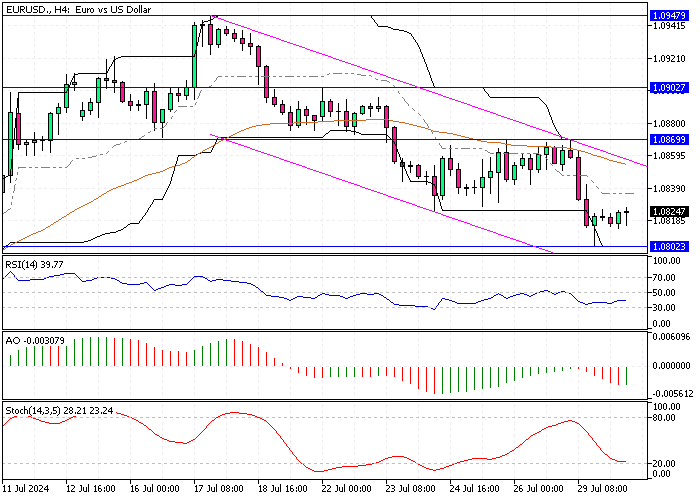

The Euro fluctuated around $1.083 (EUR/USD), drifting away from the four-month peak of $1.094, which reached July 17th. This shift reflects the market’s cautious sentiment as traders anticipate critical economic data releases this week.

These data points will help reassess predictions regarding a potential interest rate cut by the European Central Bank (ECB).

Key Economic Data on the Horizon

Traders eagerly await preliminary Q2 GDP growth and inflation figures from the Eurozone’s major economies, including Germany, France, Italy, and Spain. These reports will offer crucial insights into the region’s economic health and price pressures. Such data is essential for understanding the broader economic trends within the Eurozone, influencing market expectations and monetary policy decisions.

Recent Economic Performance

Last week’s flash Purchasing Managers’ Indexes (PMIs) for the Eurozone revealed a surprising stagnation in private sector activity in July. This stagnation was primarily due to a significant decline in manufacturing and a slowdown in services. Germany and France, two of the largest economies in the region, continued to lag, underperforming compared to the broader Eurozone.

Market Expectations and ECB Decisions

Currently, traders are assigning a nearly 90% chance that the ECB will implement another interest rate cut in September. Despite keeping rates steady in July, ECB President Christine Lagarde mentioned that the decision for September remains ‘wide open.’ This uncertainty keeps traders on edge as they closely monitor upcoming economic data to gauge the likelihood of such a policy move.

- Also Read: USD/CNH Analysis – 29-July-2024

EURUSD Fundamental Analysis – 30-July-2024

The forthcoming economic data will be pivotal in shaping market forecasts and the ECB’s monetary policy. If the data indicates continued economic stagnation and low inflation, the likelihood of an interest rate cut may increase, potentially weakening the Euro further. Conversely, signs of economic recovery could lead to more stable interest rates and support for the Euro.

In summary, the Euro’s movement and the ECB’s future decisions are intricately linked to upcoming economic reports. Traders and investors should stay informed and be prepared for potential market shifts based on these key data releases.

Comments are closed.