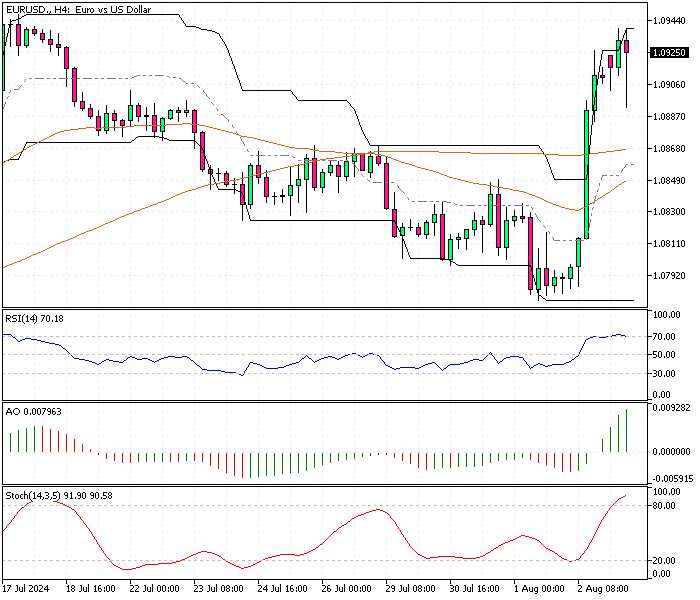

EURUSD Fundamental Analysis – 5-August-2024

The Euro is trading around $1.092 (EUR/USD), gaining strength due to the general weakness of the US dollar. This trend has emerged following a disappointing US jobs report, raising concerns about the health of the US economy.

As a result, there is growing speculation that the Federal Reserve may need to cut interest rates three times this year instead of the initially expected two cuts.

Fed’s Potential Rate Cuts

The US jobs report has sparked fears about economic stability, suggesting the need for more aggressive monetary easing by the Federal Reserve. Should these rate cuts occur, it would be an attempt to stimulate economic activity by making borrowing cheaper and encouraging spending and investment.

ECB’s Rate Reduction Strategy

In Europe, traders anticipate at least two more interest rate reductions by the European Central Bank (ECB) this year, with the next one likely in September. ECB official Stournaras has pointed out the potential for inflation to drop below the 2% target, reflecting the ongoing struggles within the Eurozone economy. This highlights the ECB’s efforts to combat sluggish economic growth through monetary easing.

- Also read: USDMXN Analysis – 2-August-2024

EURUSD Fundamental Analysis – 5-August-2024

On the economic front, the annual inflation rate in the Euro Area surprisingly accelerated to 2.6% in July. However, a positive note was observed as services inflation eased for the first time in three months.

Preliminary estimates revealed that the Eurozone economy grew by a faster-than-expected 0.3% in the second quarter, with notable growth in France, Italy, and Spain. Conversely, the German economy experienced an unexpected contraction, indicating mixed economic performance across the region.

The interplay of these factors suggests a complex economic landscape. The Euro’s strength amidst dollar weakness, coupled with anticipated rate cuts by both the Fed and ECB, points to a period of significant monetary policy adjustments.

These actions are expected to influence market behaviors, with investors closely monitoring inflation trends and economic growth rates to make informed decisions. As the situation evolves, monitoring central bank policies and economic indicators will be crucial for anticipating future market movements.

Comments are closed.