EURUSD Fundamental Analysis – 5-September-2024

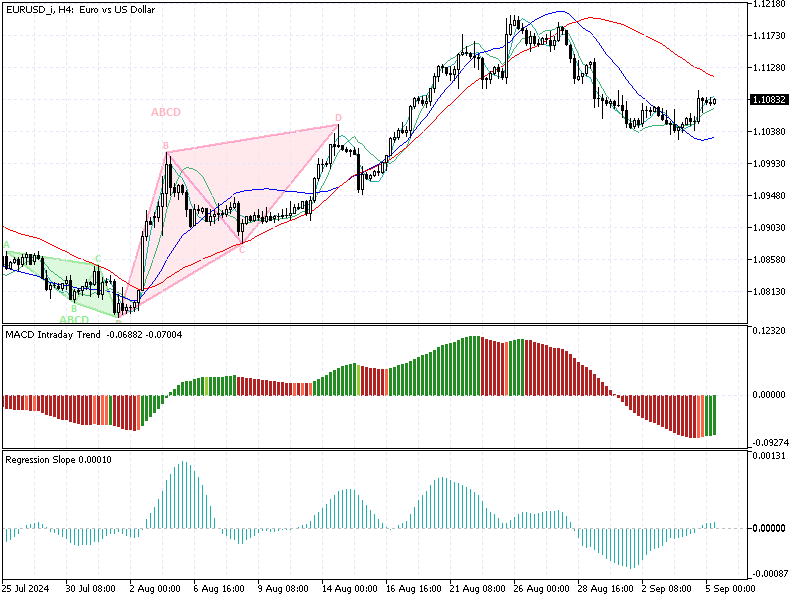

The Euro was valued at around $1.108 (EUR/USD) at the beginning of September, staying close to its lowest point since mid-August. Traders expect the European Central Bank (ECB) to reduce interest rates again during their meeting on September 12th.

This expectation grew stronger after early data showed that inflation across the Eurozone dropped to 2.2% in August, marking the lowest inflation rate since July 2021. Additionally, core inflation, excluding energy and food prices, decreased to 2.8% after staying at 2.9% for the past three months.

Growing Expectations for More ECB Rate Cuts

Traders anticipate the ECB will make two or three more rate cuts by the end of the year. A rate cut is when a central bank lowers the cost of borrowing money, which can help boost spending and investment in an economy.

The drop in inflation is one of the key factors leading to these predictions, as lower inflation may give the ECB more reason to lower rates to support economic growth.

Manufacturing Sector Continues to Struggle

Another important factor influencing the Euro is the manufacturing sector’s performance in the Eurozone. In August, the manufacturing PMI (Purchasing Managers’ Index) confirmed that this sector remained in a contraction, meaning it is shrinking rather than growing.

This weakness is primarily due to struggles in Germany and France, two of the largest economies in the Eurozone. A shrinking manufacturing sector can signal an economic slowdown, pushing the ECB to lower rates to boost activity.

Comments are closed.