EURUSD Fundamental Analysis – June-24-2024

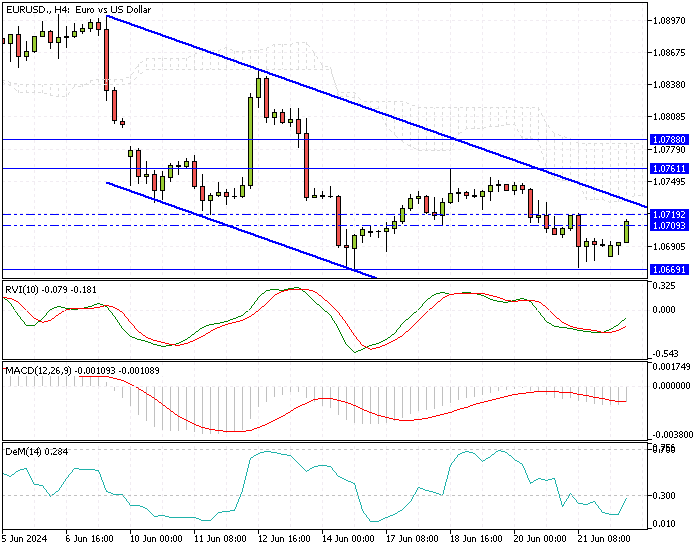

EUR/USD—The Euro has dropped to below $1.070, reflecting ongoing economic concerns in the Euro Area. This decline is influenced by weaker-than-expected June purchasing Managers’ Index (PMI) data, which have raised fears of an economic slowdown.

Manufacturing and Services Decline in the Eurozone

PMI data, crucial for gauging economic health, showed that manufacturing in the Eurozone, Germany, and France contracted more than anticipated. Additionally, the services sector experienced an unexpected slowdown across the Euro Area and Germany, with France witnessing an even sharper decline.

These indicators suggest that economic activity is weakening, prompting speculation that the European Central Bank (ECB) might consider further interest rate cuts to stimulate growth.

US Dollar Strength Pushes Euro Down 0.2%

The Euro has depreciated nearly 0.2% over the week in the currency market, reaching a seven-week low. This decline is exacerbated by political instability in France and the overall strength of the US dollar. The dollar’s resilience is partly due to the Federal Reserve’s slower pace in easing monetary policy than other major central banks.

Summary

For investors and businesses, understanding these trends is essential. The weaker Euro could impact trade and investment decisions, while potential ECB policy changes might influence borrowing costs. Staying informed about these economic indicators can help make strategic decisions amidst this uncertain financial landscape.

Comments are closed.