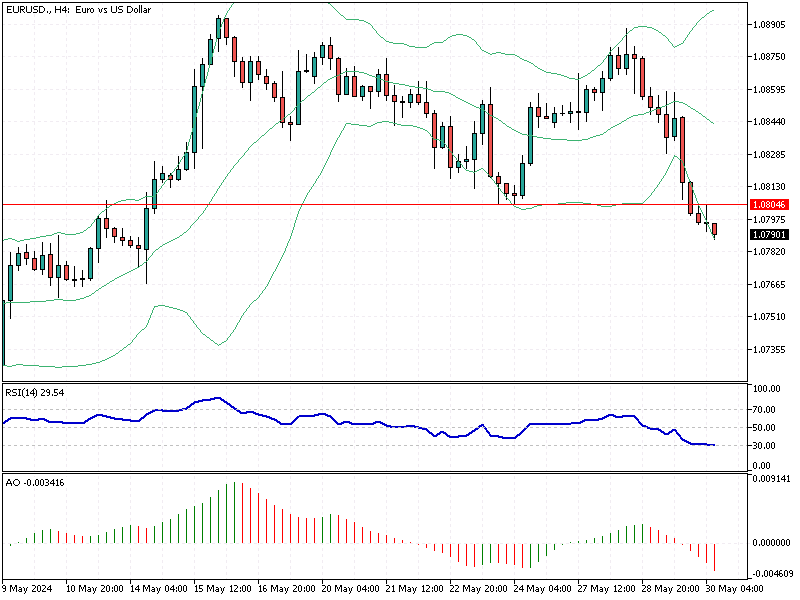

EURUSD Fundamental Analysis – May-30-2024

EURUSD Fundamental Analysis—In the final week of May, the euro maintained a steady position at $1.086, just shy of the two-month high of $1.088 reached on May 15th. This period saw markets closely watching the European Central Bank’s (ECB) next moves on monetary policy.

EURUSD Fundamental Analysis – May-30-2024

Germany’s EU-harmonized inflation rate for May slightly surpassed expectations, rising to 2.8%. Although this increase wasn’t significant enough to threaten the ECB’s anticipated rate cut next week, it did introduce some uncertainty. The stronger-than-expected growth, highlighted by May’s Purchasing Managers’ Index (PMI), suggested that the ECB might face challenges in maintaining a looser monetary policy into the third quarter.

At the same time, signals from the U.S. Federal Reserve indicated a less likely chance of a rate cut in the U.S. by the third quarter, contributing to the pressure on the euro-dollar exchange rate. (Source Bloomberg)

Conclusion

A complex mix of economic indicators and policy expectations influence the euro’s current stability. Germany’s inflation and growth data have added some uncertainty about future ECB actions, while the U.S. Federal Reserve’s stance also impacts market sentiment. As these dynamics unfold, staying informed about these economic indicators can help guide financial decisions.

Comments are closed.