GBPUSD Drops to $1.29 Amid Budget Concerns

The British pound fell to $1.29, reaching its lowest point since mid-August. This drop was due to worries about the Labour government’s first Budget, which was unveiled on Wednesday. The pound fluctuated between gains and losses, ultimately losing value as traders analyzed the new policies.

Key highlights from the Budget include:

- An annual increase in borrowing by £28 billion throughout the parliamentary term.

- Bond sales amounting to £297 billion this fiscal year, marking the second-largest on record.

- Tax increases totaling £40 billion are intended to boost funding for public services and fill a £22 billion budget gap left by the previous government.

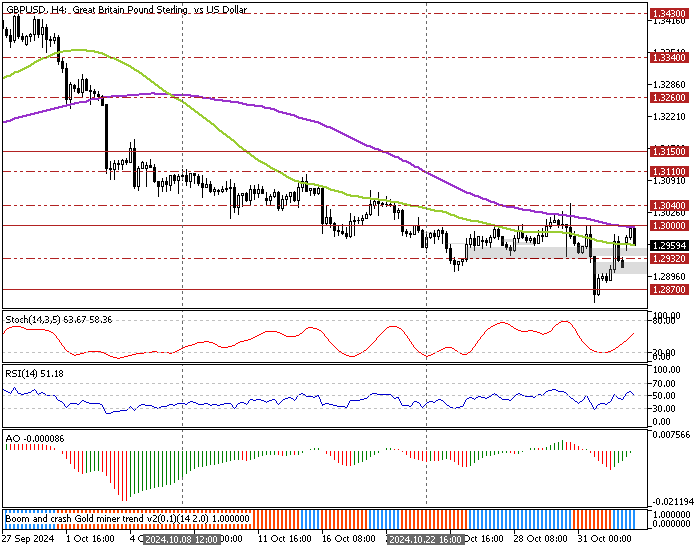

The GBP/USD 4-hour chart below demonstrates the price, support, and resistance levels.

UK GDP Growth Forecast Adjusted Inflation Rises Slightly for 2025

In addition, the Office for Budget Responsibility updated its GDP growth forecasts. It raised this year’s growth estimate to 1.1% but lowered the projection for 2025 to 2%. Inflation is expected to average 2.5% in 2024 and slightly rise to 2.6% in 2025.

The Bank of England is still anticipated to cut interest rates by another 0.25% next week. Nevertheless, traders now expect three quarter-point rate cuts by the end of 2025, compared to the five cuts they predicted last week.

Comments are closed.